How to Calculate Pip in Forex Trading

![]()

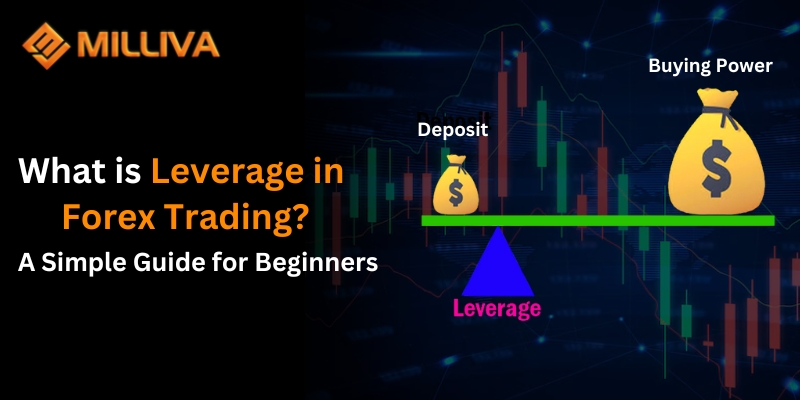

What is a Pip?

In forex trading, a pip is a unit of measurement. That is use to describe the difference in value between two currencies. The smallest regulate adjustment that a currency quotation can make called a pip. Lets learn how to calculate Pip in forex trading in this blog.

Its literal meaning is ‘point in percentage’. Traders use pips to compute the gap between the bid and ask prices of a currency pair. As well as to quantify the profit or loss on their transaction.

A pip is the fourth decimal place in most major currencies; hence a one pip change is equal to 0.0001. However, certain exceptions exist, such as the Japanese Yen, where a pip is the second number following the decimal point.

We commonly display an extra decimal denoting a fraction of a pip. Even though a pip is generally the second or fourth decimal place. Because it is a measure of market price change.spread in a currency pair may be express in pips. pip is equivalent of a ‘point’ of movement at IG. We measure currency movements in pips for CFD transactions, but we call them points.

Pips and Their Functions

The term “pip” refers to a fundamental notion in foreign exchange (forex). Bid and ask for quotations that are accurate to four decimal places used to distribute exchange quotes in forex pairings. Forex traders, to put it another way, buy and sell a currency whose value expressed in relation to another currency.

Pips are a unit of measurement for exchange rate movement. Lowest change for most currency pairs is 1 pip since most currency pairs quoted to maximum of four decimal places. The value of a pip estimated by dividing the exchange rate by 1/10,000 or 0.0001.

Currency Pairs in Forex

Trader who wishes to purchase USD/CAD pair for eg, would buy US dollars & sell Canadian dollars at the same time. A trader who wishes to sell US dollars would sell the USD/CAD pair while simultaneously purchasing Canadian dollars.

Traders frequently use the term “pips” to refer to difference between bid and ask prices of a currency pair.Also for the amount of profit or loss that may be achieved from a trade.

Japanese yen (JPY) pairings are quoted with two decimal places, which is unusual. 1 The value of a pip is 1/100 divided by the exchange rate for currency pairs like EUR/JPY and USD/JPY. When the EUR/JPY is quoted at 132.62, one pip is 1/100 132.62 = 0.0000754.

How to Calculate Pip in Forex

A pip is the metric for expressing the difference in price between two currencies. ‘pip’ stands for ‘percentage in point.’ Professional forex traders frequently express their earnings and losses in terms of pips gained or lost.

If the EUR/USD rises from 1.2712 to 1.2713, the 0.0001 increase in the exchange rate equals ONE PIP.

In exception of Japanese Yen which only goes to two decimal places. All major currency pairings go to the fourth decimal place to quantify a pip. Some brokers only quote to the fourth and second decimal places (for JPY pairings), whereas others, quote to the fifth decimal place to give even more precision when calculating gains and losses. A pipette – one-tenth of a pip – is what we call the fifth decimal point.

For example, if the EUR/USD moves one pipette (0.1 pips) from 1.27128 to 1.27129, we may say it has moved one pipette (1 tenth of a pip). So, now that we know what a pip is, how does it affect the amount of money we gain or lose with each movement?

This, of course, is dependent on the size of the position we’ve created. With bigger holdings, each pip change in the pair has a bigger monetary impact on our balance. It is pretty straightforward to compute this. We just double the size of our location by 0.0001 (or ONE PIP): Let’s keep with our EUR/USD pair as an example. For the time being, we’ll ignore the price and focus on how much money a pip move will cost for various position sizes.

Let’s Imagine we wanted to Open a 10,000-unit Position

To determine what a one pip movement implies to us, we used the following formula : Calculate Pip in Forex Trading

0.0001 (one pip) * 10,000 (units) = $ 1 per pip

So a $10,000 (BUY or SELL) position indicates that every time the pair moves 0.0001 (i.e. ONE PIP), we will earn or lose $1.00, depending on which direction it goes.

As a result, with a position of this magnitude – 10,000 units – every pip change in either direction will result in a $1 gain or loss. So, if the EUR/USD rises 100 pips (or 1 cent) in our favour, we will profit $100.

This is something we can perform for any trade size. The formula is just the trade size multiplied by 0.0001. (1 pip).

$ 0.50 per pip = 5,000 (units) * 0.0001 (one pip).

60,000 units multiplied by 0.0001 (one pip) is $6 per pip.

123,000 units multiplied by 0.0001 (one pip) equals $ 12.30 per pip.

Our pip value will always be measured in the currency of the fx pair’s quote currency, i.e. the currency on the pair’s right-hand size. As we can see in the EURUSD example, our pip value is always in US Dollars.

The pip value will be in Pound Sterling if we are trading the EURGBP pair. So…

$ 1.00 per pip = 10,000 units * 0.0001

As a result, we must assess whether we have a trading account in a different currency denomination, as brokers provide accounts in the US Dollar, Euro, Pound, and Yen. So, using our EURGBP example above, let’s imagine we have a Euro platform with a current EURGBP exchange rate of 1.5000.

Then our broker would automatically translate each pip movement of 1.00 to – we just divide 1$ by the current EURUSD rate of 1.26500, which is 0.79c.

Visit us : www.milliva.com