How to Calculate Moving Averages in Forex Trading: Insights from Forex Experts

![]()

Moving Averages are vital and very significant in foreign exchange trading. They prevent price historical data from excessive volatility and enable one to evaluate market movements. Moving averages allow traders to forecast and grasp market price movements and, consequently, the price for an asset at a given point based on the more substantial probabilities. This blog will explain what calculating a moving average in forex means, the types of moving averages, and their best practices.

What Is a Moving Average?

Every trader starts by predicting how the markets will behave. A moving average focuses on historical data for specific periods. During forex trading, moving average techniques are used to determine the prices of particular currency pairs, usually, the closing prices, to eliminate price movement and focus on trends.

The moving average is essential since it enables a trader to be able to achieve the following:

- Remove the noise from price movements within a certain period.

- Assess the current trend and what direction it is headed.

- Give traders appropriate opportunities to buy or sell.

- Give actual trends that will act as entry signals for buying or selling.

Forex trading uses two main types of moving averages: simple moving averages(SMV) and Exponential moving averages(EMV).

Simple Moving Average (SMA)

The Simple Moving Average (SMA) is the most straightforward type of moving average. It calculates the average of a specific number of price points over a given period, with each price weighted equally.

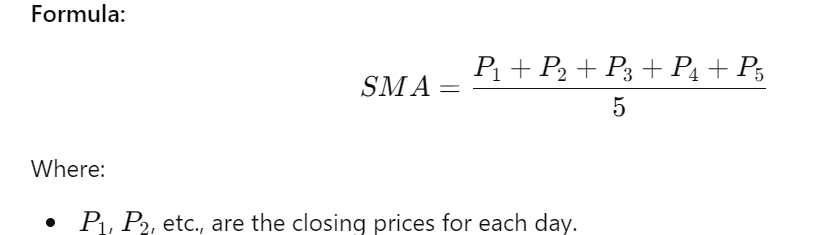

How to Calculate the SMA:

To calculate five days SMA, for instance, doing the following procedure should suffice:

- Add the closing prices for the last five days.

- Divide the total by 5.

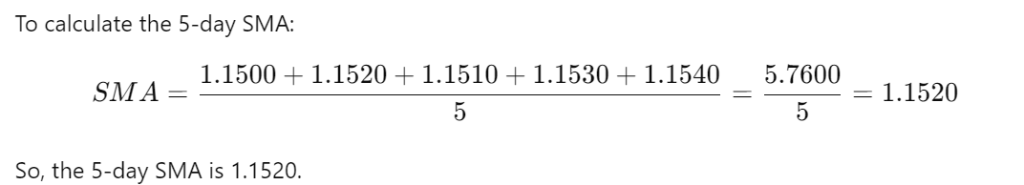

Example:

Let’s say the closing prices for the last five days are:

- Day 1: 1.1500

- Day 2: 1.1520

- Day 3: 1.1510

- Day 4: 1.1530

- Day 5: 1.1540

How Traders Use the SMA:

- Learning to read price action: If the current price stands at the SMA, the market is consolidated, with prices oscillating around the same averages. However, there needs to be a clear momentum, too. The trend is upward when it is above the SMA and vice versa. When it is below the SMA, a downtrend is present.

- Support and Resistance: Such SMAs are, therefore, positioned at possible support or resistance levels, which provide trades with favorable conditions for making exits through appropriate entries.

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a more responsive version of the SMA. Unlike the SMA, which gives equal weight to all prices, the EMA gives more weight to recent prices, making it quicker to respond to recent price changes.

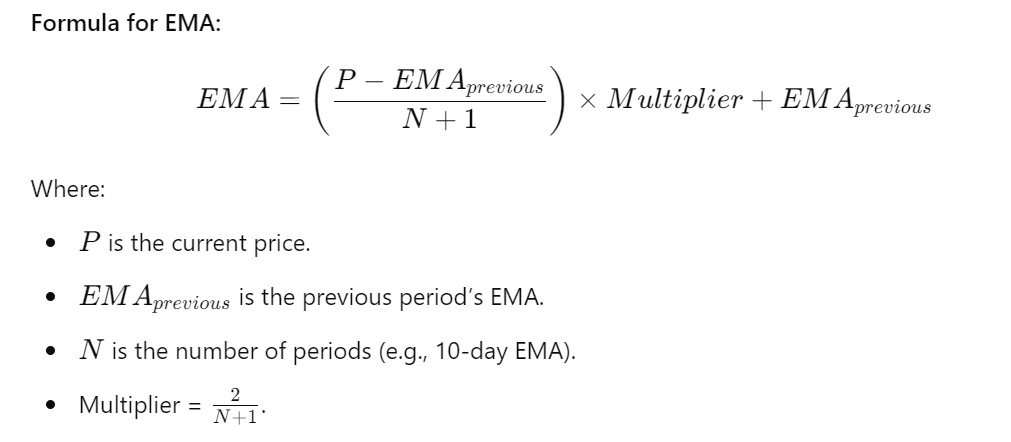

How to Calculate the EMA:

The EMA calculation is more complex because it weighs the most recent price heavily.

Example:

To calculate a 10-day EMA:

- Start with the SMA for the first period as your initial EMA.

- Apply the formula for each subsequent price point.

Let’s assume a previous EMA of 1.1520 and a current price of 1.1540. For a 10-day EMA, the multiplier would be 2/10+1=0.1818.

Using the EMA formula:

EMA=(1.1540−1.1520)×0.1818+1.1520=1.1524

So, the new EMA is 1.1524.

How Traders Use the EMA:

- Trend Confirmation: Traders often use the EMA to confirm the strength of a trend, especially over short-term periods (e.g., 10 or 20 days).

- Crossover Strategy: A popular method is the moving average crossover, where traders look for short-term EMAs (e.g., 10-day), crossing over long-term EMAs (e.g., 50-day) as a buy or sell signal.

Which Moving Average to Use?

The selection of SMA and EMA depends on your style of trading and the phase of the market:

- A simple moving average provides a more helpful indicator for traders who intend to eliminate the noise in prices and trends to focus on the long term.

- EMA is preferred by short-term traders who need quicker signals and are more interested in recent price action.

However, many traders prefer using both moving averages together. The EMA is used for short trades on formal days, and the 50-day SMA is used for long trades.

Applying Moving Averages to Forex Trading

Here are some methods you can use moving averages to enhance your trading strategy:

Trend Following:

- During a strong uptrend, the price will tend to trade above the moving average; consistently, it would trade below a downtrend. There is an inevitable trend that, when followed and MAs are used, traders can significantly circumvent following the market in the wrong direction by following a different path of embarking on a trade.

Moving Average Crossovers:

- A senior strategy uses two MA lines of different time frame values: 20 EMA and 50 EMA. When a shorter MA crosses over a longer MA, it signals to buy, and when it is the other way around, sell.

Dynamic Support and Resistance:

- MAs can be used for resistance as well as support. Consider a pullback in an uptrend; the price may touch the 50-day SMA, which may become a position in the market.

Conclusion

In foreign exchange transactions, moving averages are necessary to understand the environment, resit noise, and make decisions. When you want to use some of these indicators, understanding how to calculate simple and exponential moving averages becomes very helpful. Being helpful in trend determination, conversion tactics, support and resistance tactics, and being good with moving averages is undoubtedly an essential factor when trading in the forex world.

Visit Here:https://www.milliva.com/