ABCD Pattern – Technical Analysis

![]()

The ABCD Trading Pattern belongs to the well-known harmonic pattern family. Because some traders refer to the ABCD pattern as AB=CD, we’ll use the names interchangeably in this explanation.

The ABCD Trading Pattern is the most basic harmonic pattern. One reason for this is because it has far less needs than the majority of other harmonic configurations. Furthermore, the ABCD forex pattern is considerably easier to see on a price chart. Let’s have a look at how the AB=CD pattern appears.

Retraces a Section – ABCD Pattern’s

The ABCD pattern’s price action begins with a fresh direction (A), which subsequently establishes an important swing level (B), then retraces a section of the A leg (C), and then restarts to take out the significant swing established at B, and continues until it reaches a distance equivalent to AB (D).

As a result, we anticipate a reversal of the CD price move when the CD leg reaches a similar distance to the AB leg. BC and CD should both react to Fibonacci levels at the same time.

Traders will attempt to set entry targets on the chart exactly at the start of the emerging reversal following the CD move after the AB=CD pattern is verified. The goal is to enter the market with a trading position shortly after the CD move reverses.

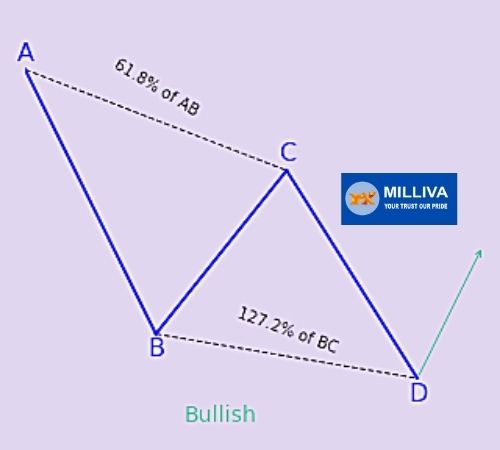

Bullish AB=CD and bearish AB=CD are the two types of ABCD formations.

AB=CD is Bullish

A price decline (AB) precedes a reversal and a rise in the Bullish ABCD Forex pattern (BC). The BC move is subsequently reversed into a fresh bearish move (CD), which takes the price below the point B bottom. All of this is depicted in the diagram below:

This is an AB=CD pattern with a bullish bias. We foresee a reversal and a price increase when the price completes the CD price move. The blue arrow on the chart depicts this.

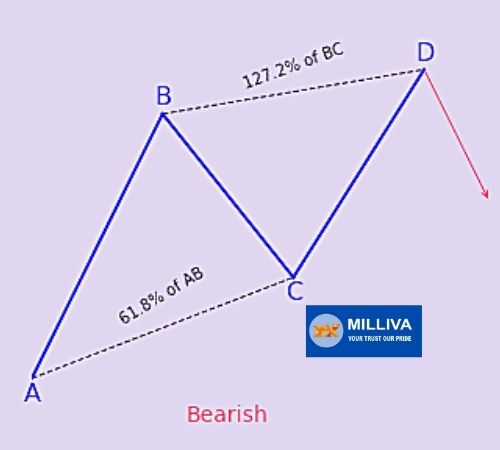

AB=CD is Bearish

The Bearish AB=CD chart pattern is identical to the Bullish AB=CD chart pattern, except everything is reversed. A bullish AB line starts the pattern, which is then reversed by a fresh bearish move (BC). A fresh bullish move (CD) then reverses the BC move, taking it above the top at point B.

You may anticipate the market to reverse again when these features appear on the graph, resulting in a fresh bearish run.

The blue arrow in the drawing above indicates the pattern’s bearish potential.

The AB leg, the BC leg, and the CD leg are the three price swings that precede the verified AB=CD Pattern. We’ll look to start a trade only when the CD leg reaches the same distance as the AB leg.

The bullish and bearish ABCD patterns are a mirror reflection of each other, as you can see. As a result, each of them is subjected to the identical trading regulations, but in the opposite direction.

Visit us on: www.milliva.com

Bearish Crab Pattern in Harmonic Trading

06th Jul 2022[…] AB =CD criteria is another qualifying condition for a deep crap formation. According to this criterion, […]

Harmonic Patterns in the Currency Markets

07th Jul 2022[…] if you’re going to go with a bearish or bullish […]

How to Trade Forex Using Trend Band Breakout Strategy

08th Jul 2022[…] the bars also change color. Green bars represent a weakening bullish trend, red bars a strong bearish trend, maroon bars a decreasing bearish trend. Lime bars represent a rising bullish […]

Harmonic Butterfly Pattern in Forex Trading

08th Jul 2022[…] that of a “M” type structure. As demonstrated by the green arrow on the drawing, the bullish Butterfly is likely to lead to bullish price action at the D […]