Advantages of Choosing ECN Broker in Forex

![]()

Forex is a market that frequently stands head and shoulders above the competition in the world of trade and investments. Its level of profitability really does speak for itself since people with the correct combination. The combination is knowledge, experience, skill, and vision can quickly grow a little sum of money into something much larger.

The number of forex brokers and the range of services offered are both increasing. Which is not surprising given the surge in global interest in forex. There are now several trading choices available to attract the attention of any enthusiastic (or aspiring) forex trader.

ECN – phrase frequently used in the forex industry. But many people are still unclear as to what those three letters actually imply. Fortunately, we are here to clarify what it all entails and outline the benefits of an ECN broker so you can understand it.

What is Exactly ECN Broker in Forex

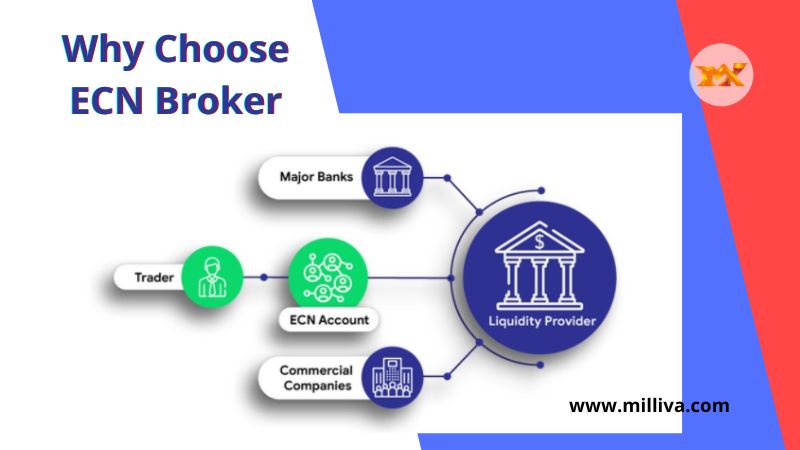

An ECN Broker in Forex is a specific kind of brokerage. That matches buy and sell orders in the currency exchange trading market using an Electronic Communications Network (ECN). In the forex (foreign currency) market, the ECN primarily functions as a computerised trading system. That automatically matches different orders between buyers and sellers.

The ECN gives current buy and sell price quotes. That show the highest bid price and lowest offer price currently available in the market for each forex trading pair. In addition to matching buy and sell orders in the market.

One currency priced against another currency in trading pairings. For instance, the trading pair EUR/USD depicts how the euro valued in comparison to the US dollar.

The largest financial market in the world, measured by dollar volume traded, is the currency market. Forex trading, in contrast, connects buyers and sellers through an over-the-counter market rather than exchanges like stock trading does.

Specifications of ECN Broker in Forex

For potential investors, an ECN broker performs trades over the ECN. Dealing with these kinds of brokers also results in lower costs and more trading time because of how an ECN functions.

Market makers do not receive the influx of orders from ECN brokers. The parties in a trade instead electronically matched, and the orders then sent to brokers in the securities markets.

Since an ECN broker matches transactions between market participants, they don’t trade against their customer or clients. ECN brokers charge their clients a fixed commission per transaction since the ECN spreads they use are far less than those used by conventional brokers.

What Benefits Can You Get from Using an ECN Broker?

The truth is that ECN brokers are becoming more and more popular among traders, and for good reason. ECN brokers have a number of significant benefits that could put them ahead of their traditional competitors. The following details the benefits of working with an ECN broker and explains why it can be the best option for you as a trader.

Privacy, anonymity, and secrecy

When using typical forex trading methods, your trading activity might frequently viewed as an open book. However, anonymity and secrecy are increased when you decide to go the path of an ECN broker—through a separate ECN account. The fact that the broker would merely be functioning as a middleman in the market rather than a market maker explains why there is such a high level of anonymity and confidentiality.

Diverse Spreads

Traders have free access to market prices via an ECN broker and a specialised ECN account. Given that prices change depending on supply, demand, volatility, and other market factors, using the correct ECN broker will allow you to trade with narrow bid/offer spreads.

Execution of Trades Right Away

The majority of the time, forex traders cannot afford to compromise on trade execution time. Effective transaction execution is pretty much guaranteed by ECN brokers at all times. The explanation for this is because this specific trading strategy allows clients to leverage the broker’s network to make orders rather than having to deal directly with the broker. Anyone can enjoy improved trade execution thanks to this novel approach.

Client accessibility and liquidity

The way ECN brokers operate gives everyone the opportunity to trade in a worldwide liquidity pool of competitive, regulated, and accredited financial institutions. Transparency is yet another important benefit of using an ECN broker because of the way related information is communicated. The same feed and deal are accessible to all ECN brokers, ensuring the transparency of the underlying market pricing from various liquidity sources.

Trade Stability

Continuity of trading is one of the main benefits of an ECN broker and a connected FX trading account. Because of the nature of forex trading, a gap between trades is neither necessary nor common. When you utilise an ECN broker, you can openly trade during news events and other breaking developments, making it feasible to create a true “flow” of activity. The opportunity for any trader to profit from forex price volatility is also made possible by this.

ECN Brokers vs. Dealing Desk Brokers

Because the ECN offers a direct link between buyers and sellers, ECN brokers are thought to be preferable than dealing desk brokers.

Dealing desk brokers, in contrast, carry out trades by either taking the other side of the transaction themselves (i.e., selling to a client who submits a buy order or buying from a client who sets a sell order) or by transferring the order to a market maker.

Dealing desk brokers come under fire on two different fronts. First, if they are taking the other side of client trades, they are basically investing against the interests of their clients, which at the very least could lead to a conflict of interest. Additionally, slower order execution caused by sending orders on to a market maker may result in clients’ orders being completed at less advantageous pricing.

Why should you choose an ECN broker to trade?

ECN brokers never trade against their customers.

Your buying and selling orders are solely routed through an ECN broker, who connects you with other market players.

As a result, an ECN broker never takes the opposite side of your trading positions, meaning that it never bets against you.

Due to the fact that an ECN broker receives a commission whether you make money or lose it, this trading strategy guarantees that there are no conflicts of interest.

Limiting price manipulation, increasing transparency, and improving trading conditions are all benefits of using an ECN broker.

ECN

Simply because an ECN broker uses prices from many liquidity providers rather than “making the market” by producing its own quotes, it is more difficult for it to influence prices.

It is more difficult for an ECN broker to manipulate prices because you may obtain real-time, up-to-date information and more precise price history when you use one of these brokers.

You can trade more quickly and with tighter spreads than with other brokers thanks to the ECN broker’s trading platforms, which clearly display prices from reputable sources. Additionally, you typically receive rapid confirmations and lower costs and charges.

You can prevent “re-quotes,” which can have a detrimental effect on your overall trading success, by accessing true quotes, which is another advantage. Typically, this occurs when your trade order is turned down as a result of a change in the price of the item you want to buy. The broker then presents you with a “re-quote” of the specified asset.

Conclusion

However, the benefits of an ECN broker truly do tend to speak for themselves, so using one could prove to be a wise course of action with the correct ECN broker—along with a flexible trading style.

visit us on: www.milliva.com