How Forex Market Analysis is Done Using Fundamental Techniques

![]()

Market Analysis and how to read the markets are two of the most important principles in trading. The majority of folks think they’re performing market analysis when they’re really just gazing at their charts. In reality, they look at multiple indicators to appraise the market 95% of the time rather than actual pricing and trend lines.

Examine the Technical and the Fundamentals

There is a lot of discussion over whether form of analysis is best for traders. To be able to analyse the Fundamentals, including central banks and economic statistics, you must first comprehend them.

Definition of technical analysis: predicting price changes using chart patterns.Price action will be taken into consideration for the date.

Short, medium, and long-term horizons

Chart analysis Must needed skill set.

The term “fundamental analysis” refers to collection of economic data. It is used to determine stock’s worth Inflation interest rates and other factors.

Medium and long-term horizons

Economics and statistical analysis are necessary skills.

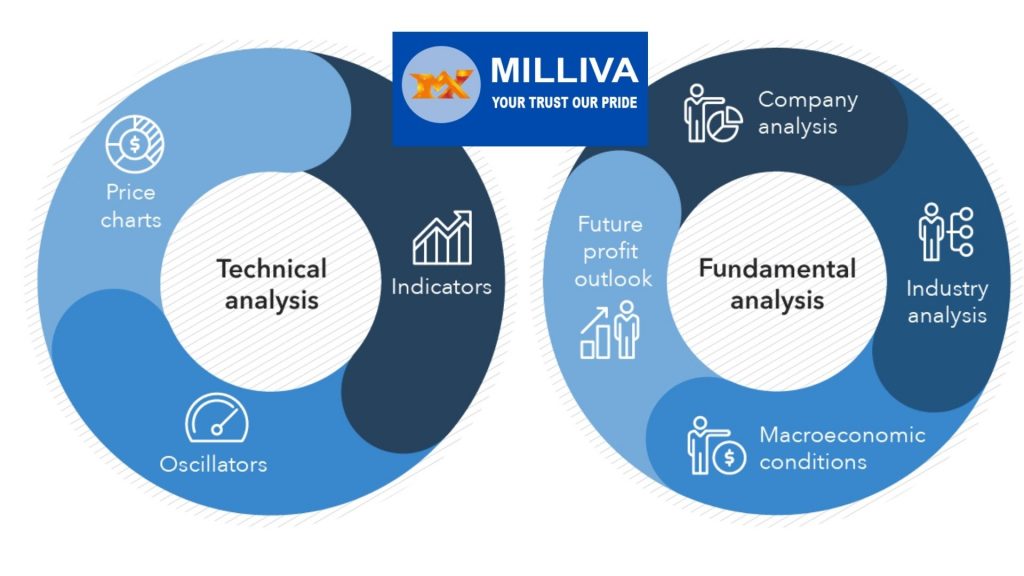

Fundamental Analysis

Fundamental analysis is the process of evaluating a country’s economic situation and, to a lesser extent, its currency. It does not, however, imply changes in currency prices. Fundamental forex traders, on the other hand, will employ data points to determine a currency’s strength. A basic forex trader would look at the country’s inflation, trade balance, domestic goods, employment growth, and even the interest rate set by the central bank.

It is used in financial industry to value the corporate stocks. It willbe used by currency traders as a major technique to assess the support for any potential exchange rate swings.

Technical Analysis

Pattern recognition on a price chart is called as technical analysis. Triangles flags and double bottoms are examples of price patterns sought by technical traders. A trader will identify the entry and exit locations based on the pattern. Technical traders, unlike fundamental traders, are unconcerned with why something is happening since they rely on the trends and patterns on the charts as their cues.

Before entering a long trade, technical traders normally place a stop loss at the most recent and lowest price and wait for the market to create higher highs and lows. A technical forex trader will look at the chart’s price movement, trend, and support and resistance levels. Many of the patterns that are employed in technical analysis of foreign currency markets may also be applied to other markets.

When analyzing the forex markets traders utilize indicators and oscillators that are added to a price chart. Bollinger Bands, MACD, Relative Strength Index (RSI), and stochastic are some of the most often utilized moving averages in technical trading strategies. These are commonly used by technical traders since they are simple to use and provide clear alerts.

Final Comments on Technical vs. Fundamental Analysis in FX

The methodologies and approaches to forex trading used by fundamental and technical analysis are vastly different. They both provide distinct value and insights to help traders make better trading decisions, as well as data on when to enter and leave trades. Some traders choose to employ these sorts of analysis independently based on their trading style and expectations, while others combine the two. When you combine fundamental and technical analysis, you get a lot of benefits.

About the Best Forex Trader In India :

Milliva the Best Broker For Forex Trading In India is a significant provider of online currency (FX) trading, contract for difference (CFD) trading, and associated services. We offer account types and services that are customized to meet the needs of all levels of retail traders.

Visit us at: www.milliva.com

Manager of Moriarti's famed PAMM account about trading.

30th Jun 2022[…] long-term deals, I also employ fundamental analysis. In challenging situations, I try to find my sentiments based on what’s going on and my […]

How to Trade Shooting Star Candlestick Patterns - Forex Trading

01st Jul 2022[…] It must appear following an uptrend and usually marks the end of that uptrend. While the shooting star pattern may indicate a potential sell-off, it may be invalidate if the candlestick pattern is follows by an uptrend continuation. […]

Where can I get the most recent forex news and updates?

02nd Jul 2022[…] updates on currency news and market analysis are provided by ForexNews.World. They are the top source for the most recent information on […]

How much money should I invest in trading?

07th Jul 2022[…] There are many different platforms available where you can implement your trading styles. Analyze and comprehend, then select your most comfortable trading platform and strategy and stick with […]

Why Social Trading is So Popular in Forex

11th Jul 2022[…] seasoned traders. Despite the fact that the majority of traders conduct their own fundamental and technical analysis, there is a subset of traders that prefer to watch and mimic the analysis of […]

How To Read And Identify Trends in Forex Trading

12th Jul 2022[…] most apparent technique to spot a forex trend is to visually examine price movement on a chart. It’s crucial to notice where the highs and […]

Signals in Forex 2022 Trading Guide in Forex

03rd Aug 2022[…] Fundamental analysis is a sort of analysis that focuses on longer-term investments and is based on a country’s economic status as determined by indicators of that situation, such as inflation rates or unemployment rates. […]

Beware of Forex Trading Myths And Misconception

08th Aug 2022[…] Technical or Fundamental Analysis: Strategies may be based on an examination of the price itself or the factors that influence price movement. Many trading systems employ a mix of technical and fundamental analysis. […]

Whipsaw Trade How to Avoid Getting Caught Up in It

29th Aug 2022[…] opening a position, you could, for instance, do technical and fundamental analysis to identify whether an asset currently overbought or oversold. Oversold assets can see a rapid rise […]

Learn How to Read and Use Relative Strength Index

07th Sep 2022[…] now change gears and talk about some RSI-based strategy development options. Using the fundamental RSI principles, we will set entry and exit points on the chart based on the signals mentioned […]

How To Predict Forex Movements

13th Sep 2022[…] Fundamental analysis is interest in the company that engage in underlying the stock of its own merit. They evaluate the company’s past performance and the credibility of the accounts that the company possesses. There is the creation of several performance ratings to help the fundamental analyst assess its validity, such as using P/E ratio. […]

Know about Forex Price Action Complete Guide for Trader

19th Sep 2022[…] essence, price action forex trading is a systematic trading method. It uses technical analysis tools and recent price history to allow […]

What's the difference between CFD Trading and Investing

20th Sep 2022[…] includes financial figures, internal business news, industry news, and so on. Also, keep in mind technical analysis, which includes indicators, chart and candlestick patterns, and price volatility, among other […]

How to Become a Certified Forex Broker?

10th Nov 2022[…] was found in 1986 and is global organization of market analysis societies and associations. In technical analysis field this is one of the best certificate. They […]

How Does Inflation Affects Financial Markets?

08th Dec 2022[…] investing, value investing entails finding and buying whose intrinsic value, as determined by fundamental analysis, lags behind its share price. Simply, the value stocks often have a relatively less price ratio and […]