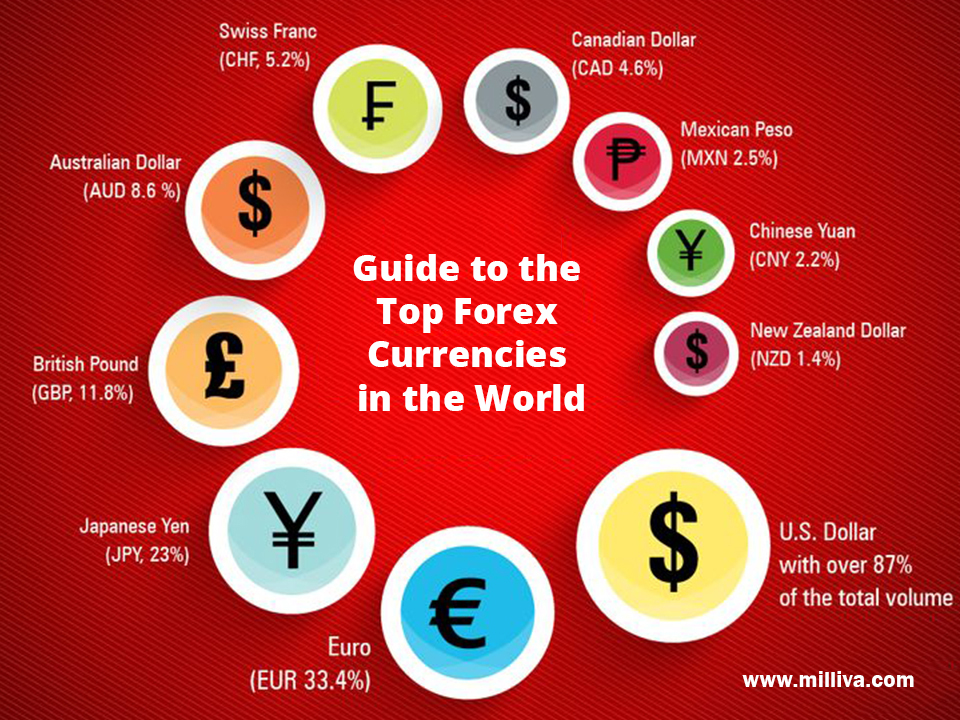

Best Currency Pairs to Trade In 2022

![]()

Forex is a trading platform where you exchange one currency over another currency. Best currency pairs to trade in 2022. A quotation for two distinct currencies known as a currency pair. It is the exchange rate at which one unit of one currency would cost another unit of another. Traders can swap 1 Euro for 1.13 US Dollars, for instance, when they see the quote EUR/USD 1.13.

Choosing of Best Currency Pairs to Trade

A currency’s value fluctuates in relation to other currencies. If the EUR/USD exchange rate increases from 1.13 to 1.15 during the next day. Either the Euro has gained value relative to the US dollar. US dollar has lost value relative to Euro, as it will take more US dollars to buy 1 Euro. In this blog we will cover all Best Currency Pairs to Trade In 2022 that assure your profit.

How to Determine Best Currency Pair?

Liquidity

This is typically the most crucial factor to take into account when choosing which currency pairings to trade. As a trader, you want to deal in currency combinations that are straightforward to buy and sell. The only exception to this rule is the trader. Who seeks to gain from the erratic performance of less liquid currency pairings. A tactic called “scalping” comprises taking little Profits Repeatedly throughout the day.

Continuity Of Prices

Price stability intrinsically linked to the economic health of the country or countries dependent on a given currency. Such as the US dollar and US pound or the British pound and British pound. When choosing which currency pair to utilize, you should consider the anticipated economic conditions of those nations.

Predictability

One benefit of trading significant currency pairings or pairs involving any major global currency. The abundance of data accessible to determine how a currency projected to behave. Less common worldwide currencies, especially those that are relatively new to the forex market, will have less historical data. Which will cause higher volatility in their performance.

Best Currency Pairs to Trade in 2022 Right Now

EUR/USD

Conversion of US dollars to euros abbreviated as USD to EUR. One of the most frequently traded currency pairs worldwide is this one. 19 of 28 nations of the EU use the Euro as their official currency, making it a reliable representation of the EU. Among the nations that utilize the Euro are Austria, Belgium, Cyprus, Estonia, France, Finland, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The dollar to euro cross will likely decline. When the European Central Bank intervenes in market activity to strengthen the Euro.

JPY/ USD

The national currency of Japan is the Japanese yen (JPY), which created as part of the Meiji restoration’s effort to modernize and westernize Japan’s economy. The value of the yen plummeted during World War II. But it has since started to rebound after hitting a low after the 1973 oil crisis.

Together with the US dollar, the Euro, and the British pound, the yen is a well-liked reserve currency at the moment. The yen held under a “dirty float” regime as a result of the Japanese government’s active stability intervention program. You can enroll in a wide variety of trading courses offered online, each of which has advantages over the others and is appropriate for different kinds of traders.

Although the value of the yen changes every day, Japan’s central banks frequently buy and sell substantial amounts of the currency to maintain stable exchange rates. The Japanese government attaches tremendous emphasis to maintaining the yen’s price in order to foster a vibrant export market. If you have USD, you can profit greatly from these daily fluctuations if you enter at the right time.

CHF to USD

The Swiss Franc is the official currency of Switzerland. The main reason people invest in CHF is to shield their investments from market volatility. The Swiss franc regarded as a “safe-haven” currency by many analysts. This implies that the CHF will typically rise during periods of unrest when other currencies depreciate in value. The CHF frequently depreciates in value while other currencies increase. During the Great Recession, CHF appreciated against every other currency with the exception of the JPY. As a result, CHF and (to a lesser extent) JPY two of the most popularly traded safe-haven currencies globally.

GBP/ USD

British pound sterling (GBP), which is accepted in England, Scotland, and Wales, is the official currency of the United Kingdom. United Kingdom never embraced Euro, unlike the majority of Western European nations, even though it was an official member of the European Union until 2016. The GBP is the third most traded currency after the USD and the EUR.

The value of the pound has been significantly impacted by two significant occurrences over the past ten years. Due to the Great Recession’s global effects, the price of the pound experienced substantial fluctuations between 2007 and 2008. Technical analysis is taught in a variety of technical analysis courses.

When GBP hit an all-time high of £2.10 per USD1 in 2007, it immediately fell to astonishingly low level of £1.40 per USD1 in 2008, which led many investors to exchange their GBP for USD. Although the pound bounced back in the years that followed, it never quite reached the 2007 record and eventually settled at about £1.60 for every dollar.

The second major factor affecting the price of GBP was Brexit, the name given to the 2016 vote that would have forced Britain out of the European Union. The pound lost nearly 10% over night and 20% in the months after the referendum as a result of investors fleeing the pound in favour of more secure currencies after the Brexit outcome.

AUD/ USD

The sixth most traded currency pair worldwide is the Australian dollar (AUD), which serves as Australia’s official unit of exchange. Due to the interdependence of the economies of Australia and Canada, the value of the AUD is closely correlated with the value of the CAD. Given that Australia is one of the top exporters of coal and iron ore in the world, the Australian dollar is also tightly linked to the commodities market. During the 2015 commodity crisis, AUD reached a level not seen since the 1970s. You should keep an eye on the price of these crucial commodities for the Australian economy if you want to invest in AUD.

USD/ CAD

It should come as no surprise that the CAD and the USD have a strong association given that Canada is America’s fiscal neighbour to the north and one of its most significant trading partners. The value of the Canadian dollar is directly correlated with the cost of commodities. The price of oil significantly affects the value of the Canadian dollar as oil exports make up a large portion of Canada’s GDP.

In 2016, as oil prices fell to levels not seen in more than a decade, the Canadian dollar also suffered, falling to a 1.46 CAD to 1 USD exchange rate. Keep an eye on the oil price if you want to convert USD to CAD to choose when to buy. The greatest tech stocks right now are on our list.

Visit us on: www.milliva.com