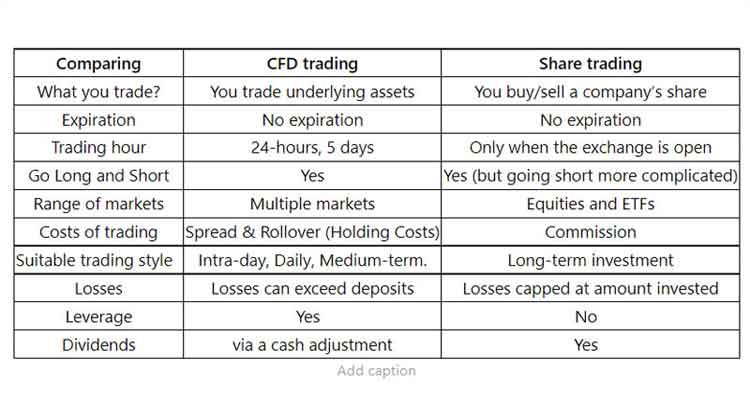

Comparison Between CFD and Stock Trading

![]()

CFD trading and stock trading are both ways to profit from market price swings. While it comes to CFD versus stock trading, one of the most noticeable differences, at least to those who are familiar with financial derivative products, is that when dealing with Contracts for Difference (CFDs) the trader never truly owns the underlying asset in this example, a company’s stock. There are significant distinctions between the two which we shall look at in this blog.

What Is CFD Trading and How Does It Work?

You speculate on prices produced from underlying security via online CFD trading, but you don’t own the underlying asset. Let’s imagine you believe the value of Facebook shares will grow in the future. You may buy a CFD stock at the current market pricing from your broker. You might sell your CFD at a new, higher price if the value of Facebook stocks rises. Your broker would then credit your account with the difference.

What Is Share Trading and How Does It Work?

The purchasing and selling of real firm shares is known as stock and share trading. Returning to our Facebook example, you may buy 10 Facebook shares if you believe the price is set to climb. You may then sell them and pocket any profit if their value rises.

Advantages of CDFs

Leverage

High leverage is available with CFDs, which means you just need to deposit a tiny portion of the overall deal value. This is the first margin, and the exposure to the funds is subsequently increased so that you may benefit more. Your investment and exposure are the same if you trade the usual way. It is still restricted in CFDs.

Go Short

When compared to traditional investment options such as stocks or commodities, CFDs provide a lot more freedom. When the market is tumbling, CFDs provide the ideal trading opportunity. Short selling is based on the assumption that the price of an asset will fall, allowing you to repurchase it at a cheaper price in the future.

Disadvantages of CDFs

No Ownership

A contract for difference is used to speculate on price fluctuations rather than to own the underlying assets. As a result, you might possess the contract but not the asset that the contract is based on, such as a stock or commodity. You can obtain dividend rights if you hold stock in a firm, but you don’t get any with CFDs.

Performance

When compared to bonds and deposit certificates, common stocks perform better. The investor’s earnings from common stock ownership, on the other hand, have no upper limit. As a result, common stocks are a more affordable and practical option to debt investing.

Advantages of Stock Trading

Right to Vote

An investor receives one voting right for each share of common stock held. These voting rights allow investors to participate in company decisions and corporate policy development. Investors may be able to elect the board of directors in some situations by exercising their voting rights. The more common stock investors there are, the greater influence they have on a company’s policies.

Liquidity

Investors may readily relinquish or invest in common stocks because of their liquidity. As a consequence, these stocks allow investors to acquire shares and then walk away with their whole investment if the firm fails to meet their expectations. Liquidity gives investors the freedom to do anything they want with their money without any worry.

Disadvantages of Stock Trading

Market Hazards

The market risk is the most significant risk connected with common stock. Market risk refers to a company’s underperformance over time. A significant drop in the company’s performance might result in the profit being eaten up by the shareholders and the shareholders not receiving the dividends they expect. This is an important characteristic to examine since, even when the firm is functioning very well, common shareholders are not the sole and first to get distribution advantages.

Uncertainty

Even though common stock might be considered a fixed-income investment, dividends are not guaranteed. The main difference is that the revenue is not guaranteed when one expects it, since it depends on the availability of money in the firm and how they are allocated.

Investors and ordinary shareholders aren’t the only ones that get paid right away when the corporation starts allocating dividend distributions. They get their dividends after stockholders and bondholders have received theirs in full. As a result, when it comes to the profitability of common stocks, there is a degree of uncertainty and lack of control.

CFD trading and stock trading both have advantages. Shares are simple to understand and less dangerous for novices. Leveraged CFDs may be profitable for experienced traders with a thorough understanding of the financial markets. CFDs can provide access to markets other than equities and shares.

Visit us on: www.milliva.com