Currency Strength Meter

![]()

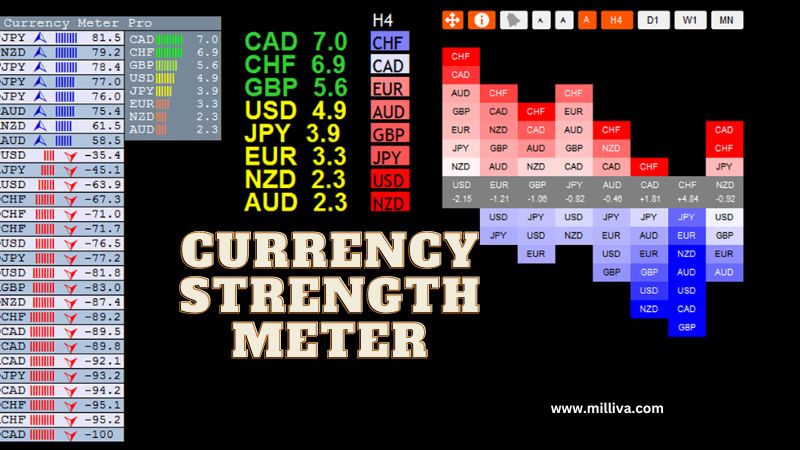

A graphic representation of the strength or weakness of currencies on the Forex market is the currency strength meter. When making decisions about forex trading, traders might use currency strength to forecast currency fluctuations.

For MT5 and other trading platforms, it is available. also accessible online. The overall, comparable strength is measuring by using real-time exchange rates in the Best Broker For Forex In India. Simple meters might not use weighted calculations, whereas more sophisticated ones do. Additionally, our computation approach displays the change’s direction (pointed with an arrow close to the name of the currency).

How Does It Work?

For those who are unfamiliar, currency meters compare all 28 cross rates to determine the relative strength of the eight major currencies (USD, GBP, EUR, CHF, JPY, CAD, NZD, and AUD) in the Forex market. For Forex traders, it’s a quick approach to determine whether market conditions positively or negatively impact their positions.

There are five steps in all:

The base currency

Match each Forex pair with the base currency.

Determine the relative strength of each currency pair.

Determine the average grade.

Use the outcome.

The strength meter’s fundamental concept is the decision-making “filter.” It enables us to ascertain crucial information, such as whether the US currency is strengthening or declining.

Another thing to keep in mind is that the strength of a given currency is always based on the periods you establish for it. For instance, the EUR is one of the weakest on the list in monthly analysis, despite being strong for the current term.

Trade FX With The Currency Strength Meter

The currency strength meter can be used in a variety of ways depending on your trading strategy. Get the strongest trend based on the pair with the strongest and weakest currencies if you are trading in the direction of the trend. Choose currencies with a minor difference in strength if you want to trade in a range. A forex strength meter should be used as an additional confirmation, as advised by experts in the Best Online Forex Trading Platform In India.

Reasons For Using Currency Strength Indicator

First, a currency strength indicator is a straightforward and user-friendly instrument. It is a priceless short-term indication. The reason can aid traders in avoiding double exposure and pointless hedging. It can also evaluate how risky the trades you just made are.

The major benefit of this currency strength meter is that it is free to use, however, the more sophisticated ones in the market require payment.

Indicators For Short-Term Trading

Currency strength meters are typically used by professional traders as scalping and day trading indicators since they point traders fast to currencies that are rising. They are a great tool for short-term speculation since they accurately depict the current strength of a currency. Additionally, some traders utilize them to validate the information they got from other indicators.

Easy To Use

Currency strength meters are simple to use and comprehend. For this reason, new traders favor them more. Currency strength meters are straightforward visual displays that clearly show which currencies are performing well and which are underperforming, so even if you are not an expert in the market or still have a lot to learn, you can grasp them.

Charge Free

As discussed before, pricey currency strength indicators that use intricate data to provide precise signals are available. But the majority of the most straightforward and efficient currency strength indicators are completely free of charge. Most of the trading systems used today allow for the addition of custom indicators and are available as plugins.

Advantages Of Currency Strength Indicator

Protection From Double Exposure

If you place repeated trades on highly correlated pairs, you will overtrade because high-correlation assets move in the same direction. If the market doesn’t move in your favor in this situation, you stand to lose a lot of money. When trading long on highly linked currency pairings like AUD/JPY, EUR/JPY, and AUD/CHF, for instance, you run the danger of double exposure.

If the market moves in the opposite direction of what you expected, you will have a large loss because of your double exposure to the JPY and AUD. Because it provides you with a straightforward graphic representation of strongly correlated currencies, a Forex currency strength indicator will warn you of such vulnerability. As a result, you can protect yourself against the risk of double exposure to weak currencies by refraining from trading these currencies.

Stops From Needless Hedging

If traders are aware of the correlation between different currency pairs beforehand, they can easily avoid unnecessary hedging. Take into account, for instance, the negative connection between the currency pairs USD/CHF and EUR/USD.

The market movement of these currency pairs moves in opposite directions when you are aware of the negative correlation between them in advance. Therefore, if you trade both of these pairs long, you will win one trade while losing the other. Currency strength meters prevent you from unneeded hedging in this way.

Identifies High-Risk Trades

Currency strength meters can also assist you in determining the degree of risk associated with the trade you just made. Take into account, for instance, that you intend to go long on the currency pairs GBP/USD and EUR/USD. These currency pairs have a positive correlation, which means that if one of the currencies gains strength, there is a double risk.

There is yet another option. A strong market movement may be indicated by one of the currency pairs, while ranging may be indicated by the other. Trading correlated pairs with opposing market movements should be avoided, according to this clear signal. For instance, you shouldn’t go long on the GBP/USD pair if EUR/USD is falling quickly and the USD/GBP pair is ranging since the USD could be stronger.

Create Your Own Currency Strength Meter

You can make your own currency strength meter if you don’t believe the industry’s currency strength meters. The strongest and weakest currency pairs are determined using price changes over a certain time period, which are calculated by all currency strength meters. You can increase the formula and weighting in your currency strength meter.

However, the most straightforward currency strength meter doesn’t need any intricate algorithms or formulas.

Step #1: Compile a list of the principal currency pairs.

Step #2: The following action is to compute the percentage changes over the previous 15 weeks. Simply insert the rate of change (ROC) indicator into the weekly time frame and change the indicator’s parameters to a 15-week period to do this.

Step #3: Lastly, order the currencies from strongest to weakest starting with the strongest. The pair receiving the highest value would be positioned first, followed by the pair receiving the second highest value, and so on.

Final Words

Before you begin trading foreign exchange, you should be aware that the market is prone to high levels of volatility and that this can cause an asset to break out or disintegrate quickly.

As a result, before opening a position, you should conduct both technical and fundamental studies on the asset you wish to trade.

Visit us on: www.milliva.com