Difference Between CFD Trading and Investing

![]()

CFD Trading: Meaning and Application

Firstly, Let’s start Difference between CFD Trading and Investing. CFD stands for contract for difference, and it is a derivative instrument that allows you to trade the price fluctuations of an asset without owning it. The price of the CFD is the price of the security you are trading.

CFD trading is similar to Forex trading in that traders open positions based on their price projections and either profit if the forecast is correct or lose money if the projection is incorrect. CFD trading is accessible on a variety of financial instruments including stocks, commodities indices futures and so on.

How the CFD Market Works

The concept behind a CFD is that you can trade a security without having to possess it. You don’t own barrels of crude oil when you purchase commodities CFD of oil, for example; you can only earn or lose money on price speculation.

When you believe the price of an asset will rise, you purchase or go long. If you believe the asset will depreciate and its price will fall, you should sell or go short.

It’s important to understand key terminology like leverage, margin, spread, and swap while trading CFDs.

Leverage

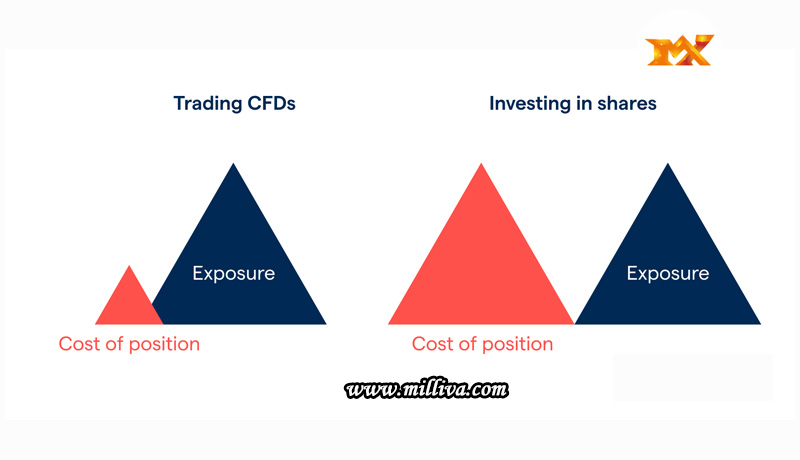

When it comes to investing, you’ll need a lot of money to buy stocks, for example. However, because a stock CFD is a leveraged transaction, you can start with $100. To refresh your memory, leverage is the ratio between the amounts you need to open a trade to the amount you use to open a transaction. Leverage increases the amount of money you have available to open a trade. For example, if the leverage is 1:100, you can open a trade with $10,000 versus $100 of your own money. Milliva the best forex broker in India provides leverage upto 1:500

Margin

The margin is a phrase you should be familiar with. The initial investment required to initiate a position is known as margin.

You should also be aware of the hazards associated with Forex trading. Leverage and margin trading increase the magnitude of the possible profit as well as the size of the potential loss.

CFD trading, like any other type of financial enterprise, has costs. Here are some words to help you understand the costs of trading CFDs.

Swap

You don’t have to close a deal within a day when trading CFDs; you may leave it open as long as your finances allow. Even so, you might have to pay a fee to keep a position available. It’s a trade. The swap, on the other hand, isn’t always a monetary exchange. It might be a monetary reward for maintaining a position overnight.

A spread is a fee you pay to a broker to get your deal executed. Spread is the difference between ask and bid prices.

CFD trading has the advantage of being tax-free.

CFD trading is done through brokers. A position can be opened on a MetaTrader or the broker’s own trading platform. CFD transactions can be conducted on the same platform that is used for Forex trading.

Example of Stock CFD Trading

Although CFDs are available for a variety of assets, we’d like to focus on stock CFDs because stocks are extensively traded and invested in.

Stocks and indices are the two possibilities for trading share CFDs.

The stock of the Company

The first is to trade a specific company’s shares. You decide which stocks have a better likelihood of moving in a given direction and place a buy or sell order (remember that when trading CFDs, you don’t own actual assets; instead, you profit from price changes, so you may buy and sell as market circumstances dictate).

Many variables influence stock selection

Fundamental analysis should be used, which includes financial figures, internal business news, industry news, and so on. Also, keep in mind technical analysis, which includes indicators, chart and candlestick patterns, and price volatility, among other things.

Indices

Indexes are the second choice. An index is a metric that measures the performance of many of the major stocks on a certain market. Because the index is a less volatile financial asset, you have the opportunity to reduce your risks. The price of all the equities included determines its direction. As a result, even if one stock soars, the increase will be constrained by the price movements of other stocks.

When it comes to trading, there isn’t much of a distinction between indexes and actual stocks. If you can forecast price direction, you might be able to benefit from both.

CFD Trading’s Advantages and Drawbacks

Consider the pros and limits of a financial product to have a better understanding of it.

| Pros | Cons |

| Funding is scarce: You can employ leverage and have restricted capital while trading CFDs. | You don’t have ownership of the asset you’re trading: CFDs aren’t for you if you want to be a shareholder because you’re only trading a price difference. |

| Purchase and sell: You can purchase and sell CFDs, which is a nice aspect of CFD trading. As a result, your chances are doubled. | Risks are higher: High trading risks apply to CFDs as well, as they do to Forex trading. Trading is the act of speculating on price changes. Markets, particularly equities markets, are prone to significant volatility. |

| Diversification is possible: CFDs can help you diversify your investment portfolio. | |

| Rapid gratification: You can open short-term transactions on minute timescales while trading CFDs. |

Investing: What It Is and How to Invest

You can invest instead of trading CFDs. Investing is the financial act of investing money, and in most cases purchasing, a financial product. You can invest in a variety of assets. Stocks, bonds, mutual funds, ETFs, and other financial Instruments are examples. The goal is to make money by holding the investment or selling it when the price rises.

How to Invest

It’s tough to emphasize common rules because there are so many different securities to invest in. Let’s look at a few instances.

A bank account deposit is a type of investment. You deposit money into an account and receive monthly income based on a percentage of your deposit. If you wish to invest in bonds, you put money into them (either at the time of placement or through a broker on the secondary market) and receive dividends in exchange for lending your money to the firm that issued the bonds.

Examples of Stock Investing

Stocks can also be purchased in a variety of ways.

Authentic shares

The first option is to buy genuine shares. You acquire one or more stocks in a firm and receive dividends. Stocks can be purchased via a stockbroker or straight from the corporation (if available). This option is accessible to you if you have the funds to purchase equities at their current market value. You may diversify your portfolio by buying real shares. However, because actual stocks have high values, it might be costly.

ETFs and mutual funds

Another approach to invest in stocks is through a mutual fund, which allows you to buy fractions of different equities. ETFs and index funds are similar to mutual funds in that they track a certain index. To diversify your portfolio, you might mix various funds.

The Benefits and Drawbacks of Investing

To Compare CFDs with Investing, we Must First Understand their Benefits and Drawbacks.

| Pros | Cons |

| Income that is earned in a passive manner: If you don’t have time to sit in front of a computer all day, investing is a viable choice. A typical investment time is measured in years. | There is a lot of money: To invest, you must have a large sum of money. Investing does not allow for leverage |

| Reduced dangers: When opposed to CFD trading, investing entails less risks. When you invest for a long time, price volatility does not play a large influence. | Taxes: There is no way to make money without spending it. On each transaction, you’ll have to pay profit taxes and stamp duty. |

| Possess a valuable asset: You either acquire an asset and keep it until it expires (for example, bonds) or you sell it (for instance, stocks). | Diversification is difficult: Although investments can help diversify your portfolio, they are more expensive than CFDs. |

What Should You Do If You Can’t Decide Between CFDs and Investing?

There isn’t a simple answer. You should select an activity that is appropriate for your objectives. You can invest if you have a large sum of money and are a passive investor. CFD trading may be a good alternative for you if you are an aggressive trader who seeks rapid gains at a higher risk. Another advantage of CFD trading is that it allows you to open more deals because it is accessible for both buying and selling.

You should establish a demo account if you have no prior experience trading CFDs or Forex. It looks just like the real thing, but it allows you to trade without risking any money and acquire experience. Please keep in mind that since this isn’t a genuine account, no loss means any profit.

Visit us : www.milliva.com

Comparison between CFD trading and stock trading

04th Jul 2022[…] those who are familiar with financial derivative products, is that when dealing with Contracts for Difference (CFDs), the trader never truly owns the underlying asset, in this example, a company’s stock. There […]

Is Forex trading legal in India - Milliva

03rd Aug 2022[…] It is a safer medium because it is protected against any default through a clearinghouse. ETDs are distinct from over-the-counter (OTC) derivatives due to their listing on a trading exchange in terms of their highly standardized nature, increased liquidity, and capacity for secondary market trading. […]

Everything You Must Know About Copper Trading

29th Aug 2022[…] CFD trading for copper enables you to trade real-time price changes without needing to purchase any actual copper. You just need to deposit a modest amount to get full exposure to the underlying trade with CFDs because they are leveraged products. Keep in mind that both gains and losses are increased because the profit or loss is determined based on the full size of the trade position. […]