Difference Between Forex Broker – A-Book and B-BooK

![]()

There are two main business models used in the forex market: A-Book and B-Book forex broker. They lay out the terms under which brokers will offer liquidity for trades executed by customers on their trading platform. To put it another way, each Broker must determine. If they want to act as a counterparty or an intermediary for their clients. These two models are not, however, mutually exclusive, and they are not the only choices.

A-Book and B-BooK Forex Broker

We must comprehend the meanings of the terms “A-book” and “B-book”. In order to distinguish between the so-called A-book and B-book forex brokers.

The main idea behind the A-book and B-book is how brokers classify. And divide their clients according to the level of risk that each client’s order poses to the broker’s dealing desk. The majority of liquidity providers in the interbank foreign exchange market have relationships with retail forex brokerages. They obtain pricing and liquidity from large banks and prime brokers active in the interbank market and break these down into smaller positions to enable them to quickly fill trading orders from clients.

Orders for Brokers

At the trading stations of the dealing desks run by the retail forex brokers, these orders are all automatically filled.

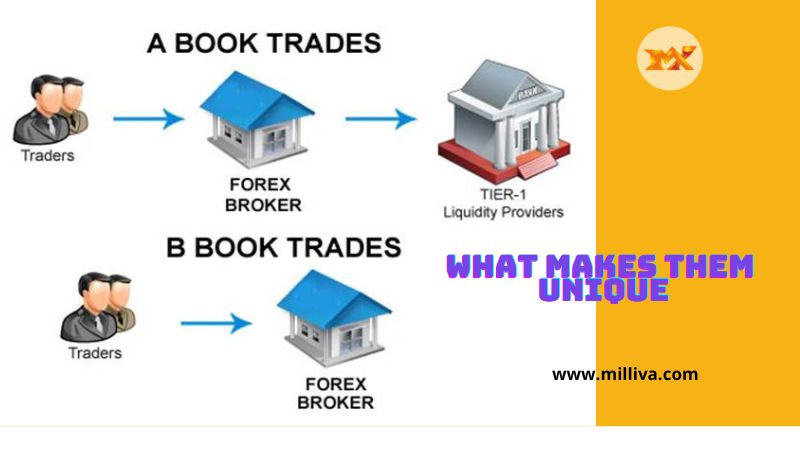

There are some orders meanwhile that cannot be performed in-house due to the size of the trade or because doing so would put the dealing desks’ counterparty role at danger. For fulfilment, certain orders will need to be directed to outside locations. This is the fundamental procedure that allows forex brokers to divide their clients’ orders into the A-Book and the B-Book, two different liquidity pools.

It must be made clear right away. That there are no exclusive A-book or B-book FX brokerages before continuing with the debate. Both models are used by almost all forex brokers, if not all of them. The forex broker’s choice of which liquidity bucket to use at any one time is based on. What their clients are doing on the market.

The dealing desk should be defined as well. A retail forex brokerage’s dealing desk is the division in charge of matching and carrying out client trade orders. These customers typically fall under the category of B-book liquidity.

A-Book Forex Broker

So who are the forex brokers from A-book? These are the forex brokers who habitually forward their clients’ orders to third parties for execution elsewhere, such as the interbank market. The classic definition of a brokerage may be summed up by them: they obtain the liquidity for their clients’ orders and then transmit those orders to other firms for fulfilment. They serve as intermediaries in these exchanges. The STP brokers’ forex brokerage model is the most similar to the A-book model. This is not to argue that market makers don’t often fulfil A-book orders, though.

Some brokers choose to employ the A-book fulfilment model for a variety of reasons. This is rather simple if a brokerage is a STP brokerage. These brokers never carry out orders internally because of their very nature. The interbank market receives all orders. In addition to the commissions levied on the buy-sell sides of the deals. Spreads are another source of income for the broker. Therefore, there is no incentive to fulfil requests internally.

The only reason that market makers who regularly fill orders internally through a dealing desk would engage in A-book fulfilment transactions is to shield their holdings from danger.

A-Book Broker

Market makers frequently hold positions that are opposed to those of their clients. Since 95% of retail forex traders experience financial losses, the counterparty operations of the market makers are enormously lucrative. The 5% of retail traders that routinely profit are present, though. It goes without saying that no brokerage wants to see their positions lose money because of rogue traders. The market makers’ reasonable course of action with such clients is to transfer them to the A-book, a different liquidity pool. The only option to avoid such counterparty risk is to ship the orders to another location for execution because the positions in the A-book are those that present intrinsic hazards to the market maker.

Banks at the interbank foreign exchange market are delighted to fill such positions when they arise because they do not have counterparty positions.

B-Book Forex Broker

What about the forex brokers from the B-book? The B-book system is always in use by the market makers, as you would have anticipated. Recall the 95% of traders that are typically losing money when trading forex? These traders are those that the broker’s dealing desk includes in the B-book liquidity category for internal order fulfilment. Such orders are commonly filled by the B-book forex brokers using their own dealing desks, typically by taking a counterparty position to the trades of these clients.

In other cases, these brokers generally use a “dark pool” to conceal the actual locations of the orders’ fulfilment. The broker may elect to send the order to the dark pool as two different traders place orders with the brokerage. A different market maker then takes up the deal and places an order for execution in the dark pool. As a result, both traders get their orders filled. Although it might not appear that the order was executed at the dealing desk, in actuality, it might have been filled in a dark pool without ever reaching the interbank market.

A-Book vs B-Book Forex Broker

The A-book and B-book forex broker models are very different from one another. While the B-book procedure results in internal order fulfilment without using the interbank market, the A-book approach uses interbank market executions for clients’ orders.

A-Book Broker

You trade with banks and have a range of options with clear pricing. Software and access to the interbank market are provided by the broker.

B-Book Broker

The purported facilitator with whom you are trading.

Ironically, it is impossible for a trader to know which book their trades are on. It’s likely that the forex broker won’t try to trade against you if you are a consistently profitable trader. Therefore, your orders will often be delivered to the interbank market. Consider yourself in a position where you constantly trade 5 lots of a commodity CFD and make hundreds of dollars per deal.

Visit us on: www.milliva.com