Elliott Wave Theory – Overview

![]()

What is Elliot wave Theory?

The fundamentals of Elliott Wave Forex Theory are surprisingly simple. In the early 1920s, a man called Ralph Nelson Elliott observed that stock markets followed predictable patterns rather than fluctuating.

Elliott Wave forecasts revealed that market cycles are intimately tied to the general public’s psyche at the time, as well as investors’ reactions to such external influences.

Following this, Elliot discovered that the rise and collapse of mass psychology followed the same predictable patterns; he dubbed these patterns ‘waves.’Elliott was able to analyse and understand the market to a far higher degree owing to its fractal nature, which is based on the Dow Theory, which posits that stock values move in waves.

Fractal

A fractal is a never-ending pattern that repeats itself again and over, becoming similar on various scales. Fractals are mathematical patterns that repeat indefinitely, and Elliott devised a method for predicting market movements after discovering these patterns (or waves) in the market.

Today, we embrace Elliott’s Wave Theory, but at the time, scientists refused to acknowledge it because of the principles and evidence on which it was founded (evidence and principles that they, too, did not recognise as science).

In-Depth Analysis of Elliott Wave Theory in Forex

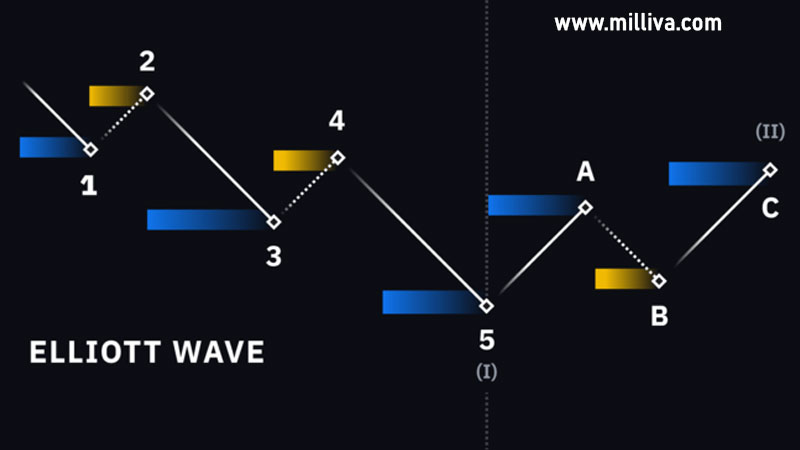

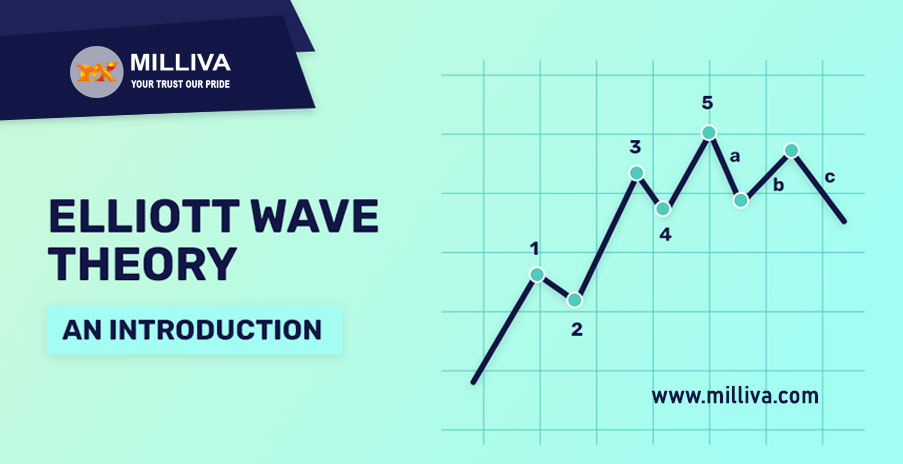

Elliott’s hypothesis is based on ‘waves,’ each of which is a portion of a fractal. For example, a ‘Impulse Wave’ (usually formed from a main/popular trend) always contains five additional waves inside its pattern; each wave within that pattern contains five more waves, and so on, in an unending loop.

Elliott labels each of these smaller wave patterns as distinct degrees in his Elliott Wave Theory predictions, but scientists didn’t accept or recognise fractals until much later.

An Example of Elliott Wave Theory in Forex

When it comes to a financial market and the price activity within it, we must remember and realise that there is always an equal and opposite reaction to every action.

If the price of gold rises, for example, you may notice more individuals selling gold than normal. If the price of gold falls, however, you may see that individuals are buying more gold than normal.

Trends (also known as impulsive waves) and corrections provided Elliott with the necessary balances and counterbalances (also known as corrective waves).Corrections counteract or work against the trend, although trends might represent the primary direction of pricing.

Each action and reaction has a precise location in the fractal, which Elliott used to establish which wave classification they belonged to, further reinforcing and demonstrating the relentlessly, repeated waves.

Visit us on: www.milliva.com

XMC.pl

11th May 2022Hi there, just became alert to your blog through Google, and found that its really informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!