How to Trade with Bullish and Bearish Engulfing Patterns

![]()

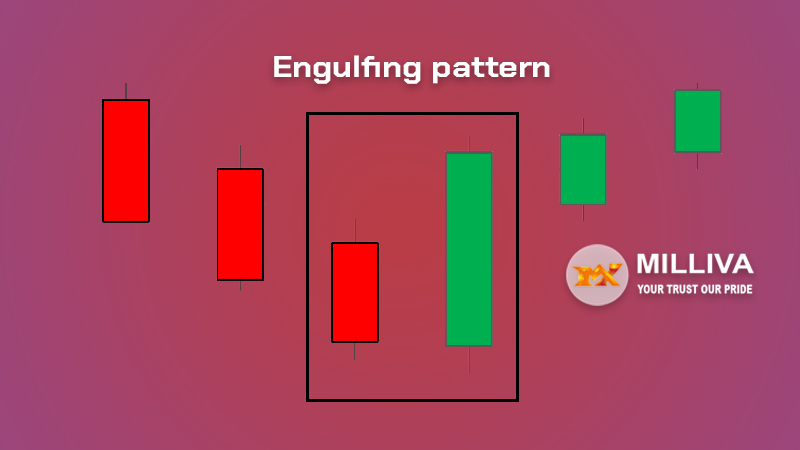

Engulfing Pattern in Trading:

A technical chart pattern called a bearish engulfing pattern alerts traders to impending price declines. Pattern consists of smaller up candle which is eclipsed or “engulfed” by a larger down candlestick (black or red).

Line, OHLC, and area charts do not give as much information as candlestick charts. As a result, candlestick patterns used to gauge price fluctuations across all time frames. There are many different candlestick patterns, but one in particular is important in forex trading.

This pattern is a great trading opportunity since it’s easy to recognize and the price movement shows a powerful and quick change in direction. In a downtrend, the actual body of an up candle will totally engulf the real body of the previous down candle (bullish engulfing). A down candle real body will totally engulf the earlier up candle real body in an uptrend (bearish engulfing).

Because the price movement signals a powerful reversal and the preceding candle has already been totally reverse. The pattern is very marketable. While establishing a stop, the trader might participate in the commencement of a prospective trend. A bullish engulfing pattern in the chart below, indicating the start of an upward trend. The entrance, in this example 1.4400, is the open of the first bar after the pattern established. The stop set below the pattern’s low of 1.4157. This pattern does not have a specific profit aim.

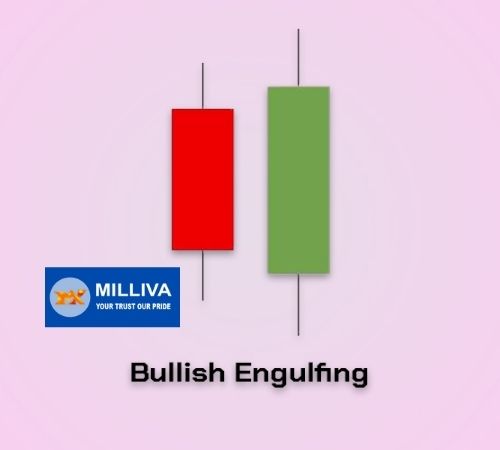

Bullish Engulfing Pattern:

When emerging at the bottom of a downtrend, the bullish engulfing candle delivers the greatest indication, indicating a spike in purchasing demand. As additional buyers enter the market and force prices higher, the bullish pattern generally signals a reversal of an established trend. The design is made up of two candles, with the second candle entirely swallowing the preceding red candle’s ‘body.’

When the bullish pattern occurs, the price movement must demonstrate a definite downturn. The enormous bullish candle indicates that buyers are flooding the market, providing an early inclination for additional higher momentum. Traders will then utilize indicators, important levels of support and resistance, and following price action after the engulfing pattern to confirm that the trend is truly turning around.

Bearish Engulfing Pattern:

The opposite of the bullish engulfing pattern is the bearish engulfing pattern. When it appears at the top of an uptrend, it gives the strongest indication, indicating an increase in selling pressure. As more sellers enter the market and force prices even lower, the bearish engulfing candle frequently signals a reversal of an established trend. Two candles are used in this design, with the second candle entirely swallowing the preceding green candle’s ‘body.’

When the bearish pattern occurs, the price movement must demonstrate a firm increase. The huge bearish candle indicates that sellers are actively entering the market, providing the starting inclination for more downward momentum. Traders will then utilize indicators, levels of support and resistance, and further price action that happens after the engulfing pattern to confirm that the trend is truly turning around.

Visit us on: www.milliva.com