Exotic Tips To Trade Gold

![]()

Tips To Trade Gold : Gold Trading has gained appeal over the past few years as forex traders look for reliable investments. That can function as a hedge against inflation, market volatility, and other geopolitical variables affecting currency pricing. Gold used by traders as a hedge against other investments or as a haven. That offers stability over time and is less susceptible to sharp fluctuations in value than many other currencies are.

Forex brokers now provide a variety of Gold Trading pairs. Including XAU/USD, making it simpler than ever to use gold in your forex trading strategy. Due to its historical price stability. Gold Trading and Gold is a valuable asset during periods of inflation like the one we are currently experiencing.

Foreign governments and shrewd forex traders are putting more of their money into gold. The hedge against losses brought on by inflation as the COVID-19 epidemic rocks the world economy. Economic practices like increasing the money supply can decrease the value of the world’s currencies.

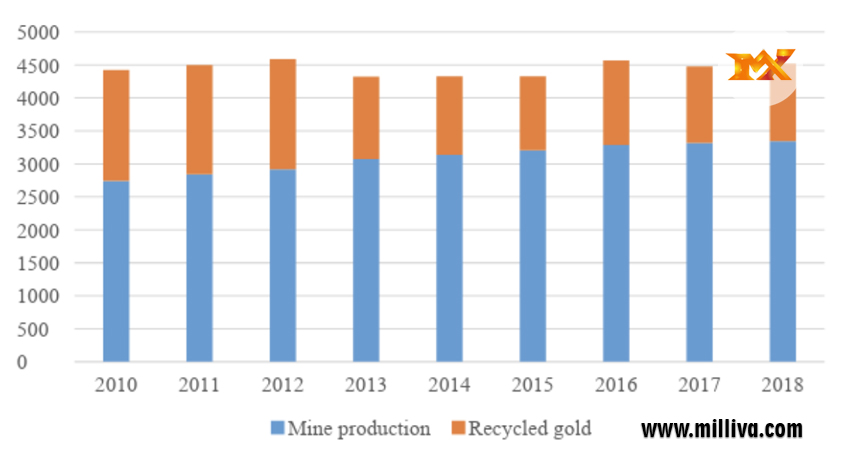

Main reason for gold’s stability is it has relatively constant global volume that cannot significantly increased. Unlike governments can issue additional paper money. Nine trading pointers to bear in mind if you’re eager to make greater use of gold and take advantage.

Day-Trade with an Eye on the New York Close (for Trading Gold)

Although the gold market is open almost constantly, New York trading hours are often when liquidity is at its highest. Your objectives will determine whether you should try to make trades during or after New York trading hours.

Off-hours trading might give additional volatility required to implement scalping tactics. Whereas trades during peak activity offer great liquidity and low volatility. Making them suitable targets for safe-haven positions. This additional volatility also raises the relative risk of any trade.

Analyses Made Simpler by Focusing on Previous Highs and Lows

Simplest trading techniques for XAU/USD is to locate buy or sell chances within the trading pair’s. Historical highs and lows because it frequently trades in a range. When gold is heading upward for instance traders can start a position and set their sell price.

These prior highs or lows likely reached by gold in the future because it a relatively stable asset. Keep in mind that this is not suitable day trading strategy It may take some time to reach targets and range-bound methods. It often don’t present possibilities for quick gains like momentum strategies do. Nevertheless, it’s a low-risk technique create to profit from consistent XAU/USD price movement.

Think About How Geopolitics Affects Currency

Gold can be reliable safe haven that safeguards your liquid assets. When political or economic unpredictability raises concerns about currency prices.

By taking a position in XAU/USD which has a strong correlation to the U.S. dollar and other stable currencies like the Japanese yen, you may be sure that your assets are safe from unpredictably impacting other currency markets.

Analyze with the Symmetrical Triangle

A straightforward chart pattern known as the symmetrical triangle denotes a period of consolidation that could result in a price breakout. Two trend lines moving in different directions but with a similar slope come together to form symmetrical triangles. Price movement on the pairing becomes tighter as consolidation occurs, perhaps presenting a trading opportunity on a breakout.

The symmetrical triangle pattern is frequently use by traders in conjunction with other technical indicators, such as liquidity or the relative strength index. The symmetrical triangle can provide further confirmation and boost confidence when other signs point to a likely price breakout.

After the two trend lines converge, a stop-loss order can set slightly below the descending trend line, and sell orders can be issue if the price of XAU/USD successfully breaks out.

Track Gold Demand from Industry and Business

Due to the fixed worldwide supply of the metal, rising market demand for gold can impact pricing. Demand can take many different shapes. Due to the material’s use in consumer projects, certain industries may increase their gold purchases. For instance, there are products and solutions that use gold in both the medical and electronics industries.

Prices for gold jewellery can also be impact by consumer demand. Take into account the global demand in nations where gold jewellery is value as both a luxury item and an investment.

Track the Central Bank Buying

When central banks predict currency instability, they frequently acquire gold as a hedge. For instance, recent news reports regarding China and Russia’s large gold investments reflect their worries about the future value of the U.S. dollar and the euro, among other major world currencies.

When central banks start making significant gold purchases, it signals two things to currency traders. First, governments are acting on the assumption that the value of the major currencies may decline, which would tempt investors to shift a larger portion of their holdings into less volatile funds.

Second, increasing central bank purchases often result in higher gold prices—at least temporarily. If gold prices begin to rise, there may be a chance to make a rapid profit.

Keep Tabs on Real Interest Rates

Real interest rates and gold prices have a well-established inverse relationship, with gold’s price falling as interest rates rise and rising as they fall. The nominal interest rate is subtracted from the real interest rate to get the real interest rate, which gives a gain or loss in percentage terms that accounts for inflation.

In the past, when the real interest rate has fallen below 1%, gold prices have tended to increase. You can spot a good buying opportunity by keeping an eye on this interest rate as it fluctuates over time, especially if you’re seeking for long-term trading chances.

A real interest rate exceeding 2%, however, is expected to depress gold’s value. If the real interest rate rises to this level, many analysts will advise selling XAU/USD.

Crossovers of the Target Moving Average

Different moving averages will cross over on forex charts as a result of the range-bound nature of gold prices. When a shorter-term moving average crosses a longer-term moving average, many traders will purchase. For long-term traders cross between 20-day moving average and 50-day moving average for instance, would indicate a purchase opportunity.

For instance, in the XAU chart below, the 50-day moving average rises above the 100-day moving average in early April 2020, when the pandemic began to seriously harm economies around the world. Unsurprisingly, this moving average crossover predicted that the price of gold would increase significantly over the following few months:

The converse is also true: Traders employing this method would probably sell in anticipation of sustaining losses if a short-term moving average dropped below a longer-term moving average.

It’s not precise science to know which moving averages to use for these calculations. But it’s preferable to leave a big gap between the two. The 10- and 20-day moving averages, for instance, aren’t distinct enough to be useful in this situation. But the 10- and 60-day moving averages are a well-liked combination for this method.

Keep an Eye on Variations in Gold Production

There haven’t been any significant changes in the gold mining industry recently. It’s not always connected to a declining demand for gold. Despite fact that market for gold and that total mining output has increased over the past ten years, today’s gold mining operations are more expensive since it is difficult to extract subterranean gold reserves in remote locations.

Gold reserves that are the easiest to access. Atleast those are currently known to have already been extracted.It added to world supply opportunity for mining companies to make profit. It is reduced since the remaining gold reserves require far more expensive mining processes.

Limited output, however, does not indicate that the price of gold is about to fall. In reality, Opposite may be true, stable gold production may constrain global demand.It drive up prices, particularly if central banks and other typical gold buyers start pursuing this asset.

Conclusion for Gold Trading

Many guidelines for evaluating forex currencies still apply. Despite the fact that the price of gold is influenced by reasons other than those that affect the price of normal forex currencies.

If they can successfully study gold’s price movements. Can create trading strategy to take advantage of this chance. forex traders should view XAU/USD as a trustworthy safe haven for their investing activities.

Visit us : www.milliva.com

Forex Trader- Technique "I Wish I Know this Earlier"

03rd Aug 2022[…] should be your top concern. I’m done now. Over the coming weeks and months, your trading will Significantly Increase if you start concentrating on this one issue right […]

What Matters More-The Quality or the Quantity of Your Trades?

06th Aug 2022[…] many years of expertise as experienced traders and on observing our online trading academy students successfully trade and invest. It is in your best advantage to heed the advice because doing so will enable you to […]