Fundamental Analysis In Forex

![]()

Changes in prices of global currencies, commodities, and metals are linked to many developments that influence a country or the Best Forex Platform In India. These can be economical or political changes and natural disasters. If we look at history, we can relate changes in management to significant companies, heads of state, fluctuations in output, currency pairs, and more.

What Fundamental Analysis Is Based On:

Traders are often interested in whether or not they can profit by predicting the price movements of an instrument before and after a particular event. History plays a role in this analysis as it helps predict the level of volatility during the release and determine which direction the trend will move if the figures come in higher or lower than anticipated.

The essential features of fundamental market analysis are as follows,

Prices do not change automatically; There is always a reason.

The impact of various factors on price movements can be predicted.

An accurate assessment of the dynamics of economic/political factors provides a reliable indicator of future price changes.

Force majeure situations impact price fluctuations but are difficult to predict.

Fundamental forex market analysis can be done independently or with technical analysis. An unfavorable prediction of future price movements may lead traders to close their open positions early or reduce losses. Some believe that news releases temporarily stop technical analysis, so if your trading strategy is based on technical analysis, you should exit the market when the price fluctuates.

Types Of News That Affect The Market

To give you a quick understanding of fundamental analysis, you can check out the Forex Economic Calendar, where the most important upcoming events worldwide are listed. It would be best to read these events separately to understand how they affect exchange rates, oil prices, metals, or other assets. No one is simply going to reveal the secret behind it. An excellent way to avoid this is to read economic calendars and other sources for previous periods and observe the actual price changes in the tables. Fundamental analysis requires an accurate understanding of the situation in the countries of the national currencies the trader plans to earn through trading in the Most Trusted Forex Broker In India.

Economic events are classified into the following categories based on how much they affect the market:

Low

Medium

High

In practice, as a result of planned and chaotic movements, messages differ dynamically at the time of publication, complicating the trading process. As a result, even if a trailing stop is executed, positions may be closed early and with less profit.

The potential profit of critical news is high. You need to know how the price will move for guaranteed profit. Any message can be profited from; Choosing the right time to open your position is essential. This approach helps maximize your earnings; When people trade the news, the process is not halfway through but at its peak.

Political Factors Affecting Price Changes

There’s a country’s domestic and foreign policy can impact that country’s national currency. For example, instability can weaken a currency, causing it to fall. During presidential and parliamentary elections, prices fluctuate only based on rumors. These situations are created to allow people to profit from temporary falls or rise in prices. The role of political news in trading is relatively small. Fundamental forex analysis considers the long-term as an additional factor with a more significant impact, while short-term trading is conducted based on economic performance.

Economic Factors

The value of a national currency relative to other countries depends on the country’s economic situation. When working with major currency pairs, the comparison is made with the US dollar, while with cross-currency pairs, it is done with other currencies, although the US dollar still plays a role in the calculations. On the one hand, this relationship currency pair reacts to any US news and, on the other hand, responds to events in the country where the “second” currency of the team is in circulation.

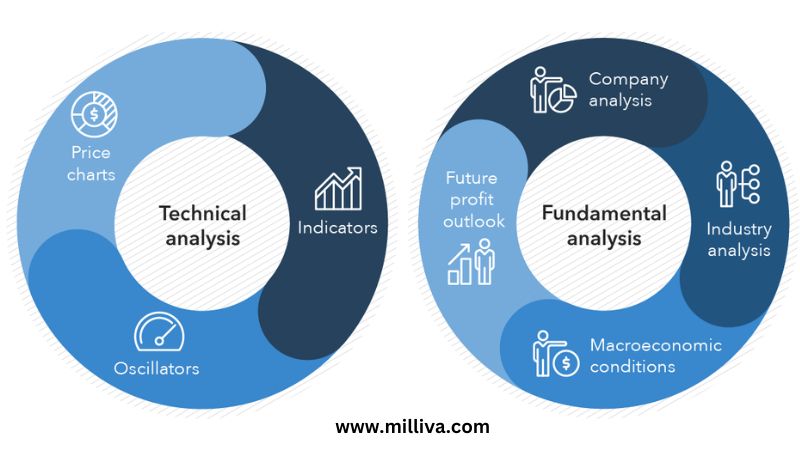

The Influence Of Fundamental Analysis On Technical Analysis

Discussions on the best type of analysis, Fundamental or technical, usually lead to the conclusion that it is better to use both. Monitoring support and resistance levels helps predict trend changes when price crosses a critical level during specific news releases. Combining fundamental and technical analysis (FA and TA, respectively) leads to a more effective outcome.

Activities performed at intervals of H4 or more should undoubtedly include fundamental analysis. It isn’t very easy to get high profits without considering political and economic factors. When you look at the price history of any asset, you can see that the price returns to its original level within a short period.

Trading Strategies Based On News

Based on economic news and policies, trading in the forex market is done manually and automatically (via “advisory” robots). The latter is configured for close or open positions before news releases, depending on the type of trading strategy. There may be technical analysis in preparation for opening orders, but the trader may discard this in favor of economic forecasts.

Traders doing fundamental analysis are recommended to subscribe to newsletters published by experienced forex analysts in the Best Broker In India For Forex. By reading independent forecasts, it will become easier to navigate the current trends. This approach is highly efficient as market signals are analyzed based on the knowledge of skilled experts.

Visit us at: www.milliva.com