How to Trade with Harmonic Price Patterns in Forex

![]()

What is Harmonic Price Patterns ?

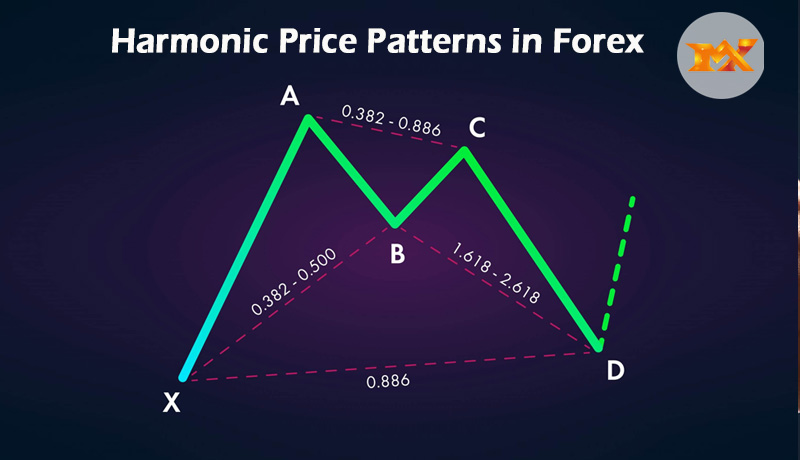

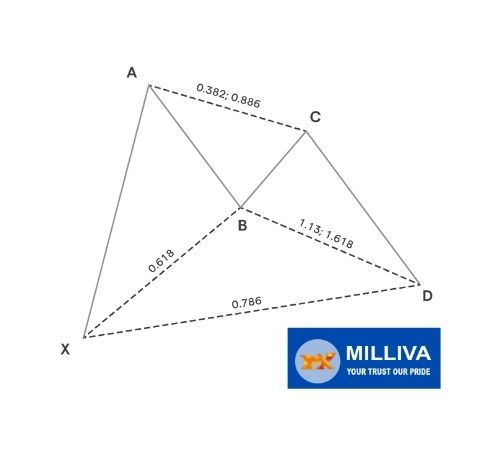

Harmonic price patterns use Fibonacci numbers to define precise turning points, taking geometric price patterns to the next level. Harmonic trading, unlike other more frequent trading approaches, tries to forecast future movements. There are a variety of chart patterns to pick from.

Each of which used to recognize a certain type of trend. It’s important to remember, though, that before you follow any pattern, you should be confident in your ability to perform your own technical analysis so that you can always make the best – and quickest – trading decisions.

Harmonic pattern using Fibonacci Numbers

Harmonic trading is a trading method that combines patterns and math to create a precise trading method based on the premise that patterns repeat themselves. The main ratio, or a derivation of it, lies at the heart of the technique (0.618 or 1.618). 0.382, 0.50, 1.41, 2.0, 2.24, 2.618, 3.14, and 3.618 are some of the complementing ratios.

Almost all natural and environmental structures and occurrences contain the main ratio, as well as man-made structures. The ratio in financial market. Which influenced by the environments and societies in which they trade, because the pattern repeats throughout nature and within society.

The trader can use Fibonacci ratios to try to predict future movements by identifying patterns of various lengths and magnitudes. Scott Carney1 is credit with inventing the trading method. But others have contributed or discovered patterns and levels that improve performance.

Follow these Steps to Starts Trading Harmonic Patterns

Spend some time learning about harmonic patterns and the theory underlying them.

Decide if you’re going to go with a bearish or bullish approach.

Create an account with us and begin looking for harmonic patterns in your preferred market.

Entries Should Fine-Tune and Losses Should Avoid

Each pattern indicates a possible reversal zone (PRZ), but not necessarily a price. This is due to the fact that point D is form by two separate projections. The trader can initiate a position in that region if all forecasted levels are near together.

Look for some further evidence of the price moving in the predicted direction if the projection zone is spread out, such as on longer-term charts when the levels may be 50 pips or more apart. This might be a result of using an indicator or simply observing the price activity.

Outside the farthest projection, a stop loss can also be applied. This indicates that unless the pattern is invalidated by moving too far, the stop loss is unlikely to be hit.

Visit us on: www.milliva.com

Butterfly Pattern in harmonic trading pattern

08th Jul 2022[…] finest results, you want to see the Double Top or Bottom emerge only after a sustained motion. The beginning of the pattern is indicated by a “X.” The four price swings of the formation are then identified as […]

Pullback Trend Indicator in Forex Trading

12th Jul 2022[…] the underlying fundamental narrative that drives price activity on a chart. They are frequently profit-taking opportunities after a large increase in the price of a […]

Harmonic Pattern in Forex

05th Dec 2022[…] must develop in the proper proportions in addition to some geometric features. The composite harmonic patterns will be formed when both harmonic and graphic patterns overlap each other. Thus, analyzing the […]