Here Are Few Examples of “Black Swan” Events

![]()

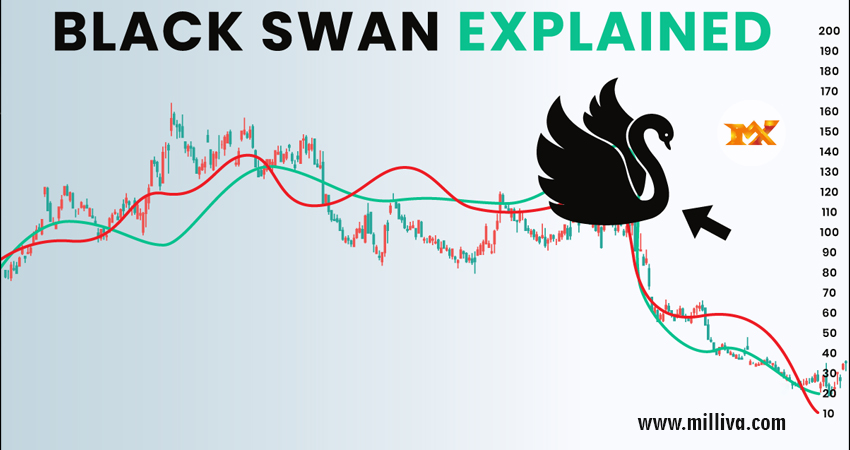

Black swan in forex :The phrase “a rare bird on Earth, like a black swan” is where the term “black swan” comes from. People in Europe once thought that swans other than white were an extinct species. Although a black swan population found in Western Australia in the 17th century, the word still to denote something improbable. What is a black swan event, then?

What is a Black Swan Theory?

American trader of Lebanese descent Nassim Nicholas Taleb wrote “The Black Swan. The Impact of the Highly Improbable” in 2007, one year before to the start of the world economic crisis. He referred to major mishaps that have an impact on all facets of life as “black swan events.”

In actuality, black swan events used to describe practically all rapid transformations. You can read about similar events in any history textbook; for instance, read about the Great French Revolution. The reader will first encounter a passage containing criteria that made clear after the revolution had already occurred.

Examples of Black Swan Events in the Past

These significant historical occurrences included under “black swans.”

The Asian Financial Crisis of 1997

Black swans have been implicated in a number of recent financial market-related occurrences. Asian crisis of 1997–1998 resulted in bank failures. Decline in value of many Southeast Asian nations national currencies and general slowdown of Asian economy in the late 1990s.

Region’s nations including Thailand, Philippines, Malaysia, Indonesia, and South Korea went through period of strong economic expansion in the middle of the last decade of the 20th century.

Foreign loans played a significant role in funding this boom, which encouraged by the US Federal Reserve’s lenient monetary policy and enticing lending conditions in local currencies. Asian economies severely over-credited as a result, which led to significant deviations and a collapse.

Black Swan in Forex

‘Dotcom’ Crash

Between 1995 and 2001, the “Dotcom bubble” was evident. Rise in Internet company stock prices (which were primarily American) and the influx of numerous new Internet businesses led to the formation of the bubble. The value of the stock of companies proposing to incorporate Internet technology soared.

The failure of these new business strategies, however, led to an uptick in bankruptcies. Investors lost nearly $5 trillion at the turn of the century because of speculation and unwarranted confidence.

The 9/11 Attacks

There are more instances besides a black swan in the stock market. One of the most awful days seemed to be September 11, 2001. Terrorists commandeered passenger-carrying commercial aircraft and crashed them into the World Trade Center’s twin buildings in New York. The attack claimed the lives of more than 2,900 individuals, which was a terrible tragedy.

The United States soon after began a significant anti-terror operation. After the disaster, several individuals began claiming that the events of September 11 could have foreseen.

The Global Financial Crisis of 2008

This incident occurred a year after the release of Taleb’s book, where he first coin the word, as already mentioned.

The US financial crisis of 2007–2008 served as the impetus for the world economic crisis. The 500 largest corporations in the nation are represented by the S&P 500 index, which dropped 38.49% in 2008.Lehman Brothers investment bank filed largest bankruptcy proceeding in history as a result of the extreme economic downturn. Which cost the company its market value of $46 billion and resulted in the loss of 25,000 jobs.

Impact of the crisis also had an influence on global stock markets which suffered $10 trillion loss as a result. Naturally, after the crisis, specialists started to contend that the conditions and causes were obvious far in advance of the collapse.

Brexit

The United Kingdom left the European Union in January 2020 after extensive preparations. Although the effects of this incident on stock prices and market volatility are still being felt, According to experts, following Brexit, the UK’s commitment to upholding human rights will be put to the test, not least because the government is hostile to many aspects of their protection, democratic institutions are eroding, there is a climate of intolerance, and many media outlets reject human rights. The loss of the economy is just one of many challenges that people encounter.

Covid-19: A Black Swan or Not

This point of view is widely held. For instance, during the Ideas Lab meeting in Brussels, scientists claimed that the coronavirus showed how fragile the international system is and how powerless states are to intervene. As a result, the economy collapsed, we became isolated and split by borders, and the WHO gave delayed and conflicting advice.

With the exception of Bill Gates’ predictions, which no one paid attention to, the epidemic that occurred over the previous several years was unanticipated for the global community and had far-reaching effects, as befits a true “black swan.”

The events in the beginning of 2020, when the COVID-19 worldwide pandemic broke out across the world, are more recent examples of the black swan in the economy. Black Thursday took place on March 12; the magnitude of the market decline that day may be characterized as catastrophic.

The S&P 500 experienced a daily decline of 9.5%, which is the lowest since October 19, 1987. Other global market indicators also reached their apex. Only by November did American indexes return to their January 2020 levels.

Visit us on: www.milliva.com