History of Forex Trading

![]()

History of forex trading is as old as humanity and a few thousand years ago. Talmudic writings mentioned individuals who assisted others in conducting transactions in exchange for a commission. These assistants are what we now refer to as brokers.

What is Forex Trading?

The barter system established by Mesopotamian tribes about 6000BC, is the earliest means of trading. Products swapped for other goods under the barter system. After then, the system expanded, and commodities like as salt and spices became prominent mediums of trade.

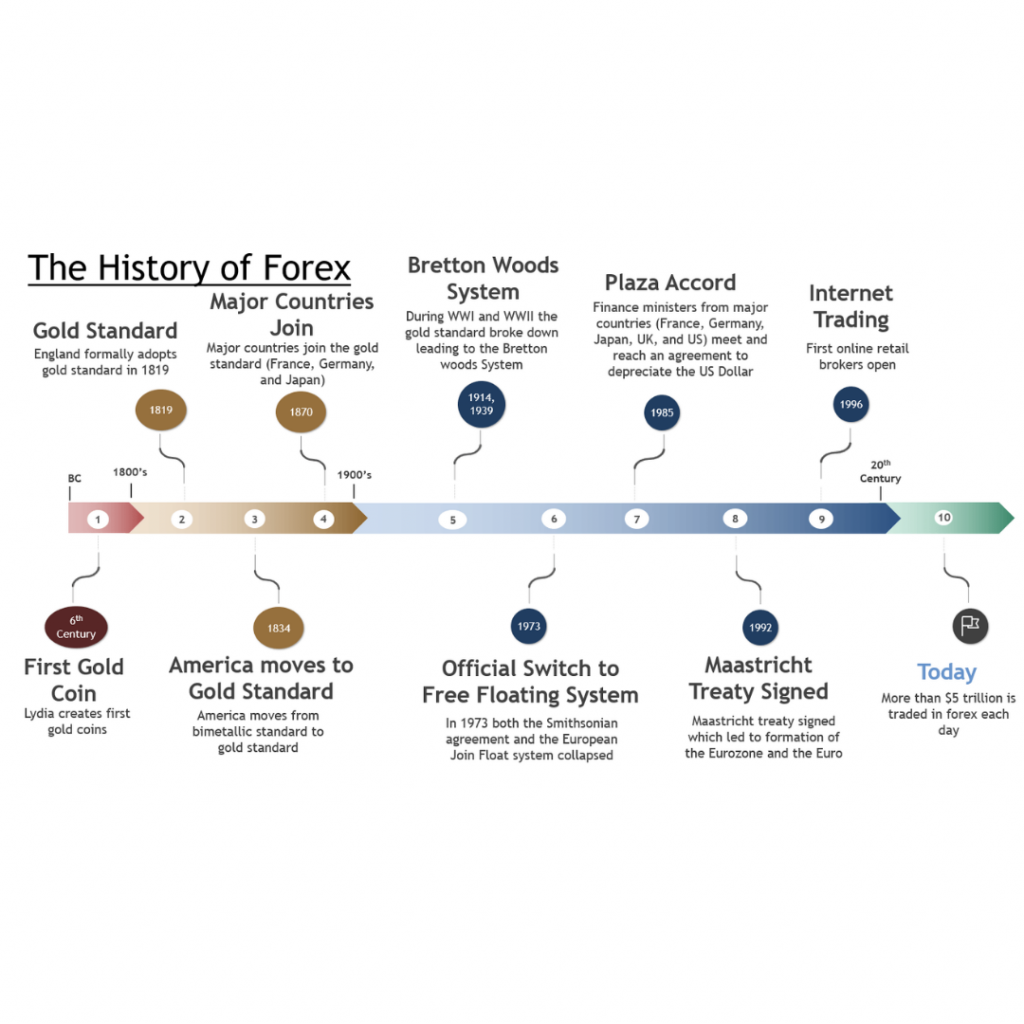

In the initial form of international commerce, ships would travel to barter for these items. The first gold coins manufactured as early as the 6th century BC. They served as a money because they possessed important features such as mobility, durability, divisibility, regularity, limited supply, and acceptance.

Gold coins generally recognized as a medium of commerce, but they inconvenient due to their weight. Countries adopted the gold standard in the 1800s. The gold standard ensured that the government would redeem any quantity of paper money for its gold worth. Functioned well until World War I European countries forced to abandon the gold standard in order to generate money to pay for the war.

At this time and in the early 1900s, the foreign currency market underpinned by the gold standard. Countries traded with one another because the currency they received might be converted into gold. The gold standard, on the other hand, could not withstand the pressures of the global wars.

Brief History of Forex Trading

1999–2008: Founding and Refco Stake

Forex Capital Markets was formed in 1999 in Nyc. Became one of the first to develop an automated trading platform on the foreign exchange market. The company was originally known as Shalish Capital Markets, but after one year, it was renamed FXCM. When FXCM built an office in London in 2003, it became regulated by the UK Financial Services Authority.

FXCM formed a collaboration with Refco Group, one of the leading US futures brokers at the time, in January 2003. Refco acquired a 35% ownership in FXCM and licensed the FXCM software to its own clients. On October 17, 2005 Refco filed bankruptcy a week after finding a $430 million swindle and two months after its first public offering. The CEO of Refco, Phillip R. Bennett eventually found guilty of the fraud.

Refco chose to sell portion of its 35% stake to FXCM for $110 million in November 2005. However, the deal rejected by Refco’s creditors in March 2006, and FXCM subsequently rejected a second $130 million bid. [20] In the end, Refco’s stake in FXCM sold to a group of investors led by Lehman Brothers Holdings.

2009–2014: Legal Issues and Initial Public Offering

FXCM, Inc. bought the UK-based ODL Group in May 2010. FXCM had already purchased ODL’s US operations in January 2009. Following the acquisition in 2010, FXCM has become the biggest and most popular forex broker, with over 200,000 clients and assets worth over $800 million.

FXCM went public in December 2010 and began trading on the New York Stock Exchange under the ticker symbol FXCM. Share pricing began at $14 per share, with a total share capital of $211 million. FXCM detailed its no dealing desk trade execution in its IPO prospectus.

The National Futures Association (NFA) fined FXCM $2 million in August 2011 for slippage misconduct. As part of the provisions of the NFA agreement, all clients harmed by price slippage paid within 30 days. The Commodity Futures Trading Commission (CFTC) ordered FXCM to pay $14.2 million in compensation to clients who had not granted positive slippage gains in October of that year.

Several class action lawsuits brought against FXCM the next year, in February and March 2011, alleging fraud and racketeering from deceptive and unfair commercial practices, as well as deceiving shareholders during the 2010 IPO. FXCM faced 13 CFTC reparations cases, 17 NFA arbitration judgements, and 8 other regulatory actions in the United States between 2005 and January 2017.

2012

FXCM obtained a majority share in Lucid Markets in June 2012 for $176 million net of Lucid funds. Lucid Markets, a London-based automated trading organisation, acknowledged at the time as one of the world’s top FX dealers, with FX volumes rivalling those of prominent investment banks.

FXCM has also agreed to collaborate with Credit Suisse on the development of the FastMatch electronic communication network (ECN). In 2013, FXCM purchased a $12 million note issued by Infinium Capital Management, a Chicago-based high-speed trader. In March 2014, FXCM bought five trading desks and certain physical assets from Infinium.

The UK Financial Conduct Authority (FCA) fined FXCM and FXCM Securities Ltd (“FXCM UK”) £4 million in February 2014 for slippage breaches and failing to notify the FCA of the CFTC investigation into the same activities. In addition, FXCM UK’s clients received around £6 million in compensation, for a total fine of £10 million ($16.9 million).

2015–2017: Swiss franc Jump and U.S. License Loss

2015–2017: Swiss franc appreciation and license revocation in the United States

Following a significant surge in the price of Swiss francs on January 15, 2015, FXCM lost $225 million and was in violation of regulatory capital requirements.

The next day, Leucadia provided the corporation with a $300 million bailout loan with a ten percent interest rate in order to fulfil its capital needs. According to the terms of the agreement, the interest rate might reach 17 percent. Later that month, FXCM said that it would forgive negative balances on 90 percent of its accounts as a result of the unanticipated Swiss franc price change.

CFTC penalized FXCM

Leucadia extended the original two-year loan by one year in September 2016.

The CFTC penalized FXCM, Inc. In February 2017, the court fined and three founding partners (including Drew Niv) $7 million for participating in fraudulent behavior. The CFTC revealed that the company’s “no dealing desk” strategy (also known as a direct market access system) routed transactions through Effex Capital, an FXCM-sponsored and controlled market maker.

The CFTC and the NFA then prohibited FXCM, as did the three original partners. In response, FXCM, Inc. renamed itself Global Brokerage, Inc. Brendan Callan named temporary CEO, following Drew Niv. Jimmy Hallac, a Leucadia managing director, was also chosen chairman.

Global Brokerage, Inc. retained its NASDAQ listing under the ticker symbol “GLBR.” Global Brokerage was told by NASDAQ in May 2017 that the market value of its stocks was insufficient for continuing listing. FXCM sold its ownership in the FastMatch ECN for $46.7 million in August of that year, using the proceeds to settle a portion of the Leucadia debt. FXCM still owing $66.8 million on the debt at the time.

The FXCM Group terminated a management arrangement with Global Brokerage in October 2017. The next month, FXCM announced that, while Global Brokerage controlled 50.1 percent of the firm, it only had a tiny economic position. Leucadia owns 49.9 percent of the company and has a 65 percent economic interest.

2017–Present: Bankruptcy and Ownership by Jefferies

Bankruptcy and ownership by Jefferies Global Brokerage, Inc. Jefferies Global Brokerage, Inc. filed for Chapter 11 bankruptcy in November 2017 and was delisted from NASDAQ in December 2017. In February 2018, Global Brokerage emerged from bankruptcy. However, at the time, Global Brokerage’s genuine economic interest in the FXCM Group ranged from 10% to 50%, depending on the amount of distributions made by FXCM. FXCM relaunched itself as “FXCM: A Leucadia Company” in February 2018. FXCM was the second-largest retail forex broker outside of Japan as of March 2018.

visit us on: www.milliva.com

Main key factors in forex markets every traders must know

05th Jul 2022[…] Prior to the 1970s, forex trading as we know it was illegal owing to the Gold Standard and Bretton Woods regimes. Because exchange rates controlled, dealers were unable to speculate on foreign currency fluctuations. After the Bretton Woods system collapsed in 1973, floating exchange rates paved the way for modern-day FX trading. […]

Top 5 Forex Trading Mentor and Educators in 2022

02nd Sep 2022[…] They’re also known for providing undeniably high-quality instruction and sharing ideas. Aims at assisting their pupils and clients in achieving favourable outcomes and establishing themselves as traders. […]