How Can I Start Copy Trading

![]()

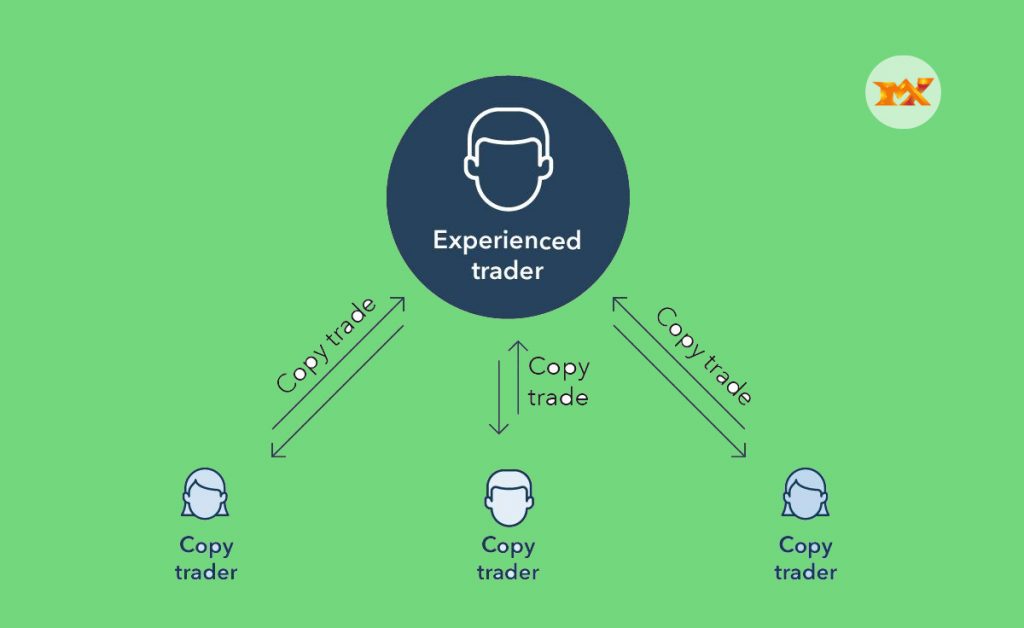

Traders with little experience in a particular market or little free time to dedicate to trading frequently use copy trading. Here, we define copy trading and describe its operation.

What is Copy Trading?

One type of portfolio management is copy Trading. Finding other investors whose record you’d like to imitate is the objective. Trades can be monitored by traders by copying the tactics of other profitable traders. Before deciding to risk real money, traders are better served by following the investor, just as with any trading technique they choose to use.

For traders who lack the time to study the markets personally, copy trading can be helpful. Although there are many various ways to make money with copy trading, it is mostly concentrated on short-term trading, particularly day trading and swing Trading Tactics. Cryptocurrencies, the currency market, and other intricate or volatile markets are frequently the subject of copy trading. While copy trading has the potential to be profitable, it may also be risky. Traders should keep in mind that past performance does not guarantee future results.

How Copy Trading Works

There are various methods for copying another investor’s trades. A trader may, for instance, clone every transaction, including trade entries, take-profit orders, and stop-loss orders. As an alternative, users might manually duplicate the transactions after receiving trade notifications. To do this, you can use a spread betting or CFD trading account, two derivative products that let you speculate on the price changes of an underlying financial asset without really owning it.

Trading in copies enables investors to diversify their holdings. This indicates that a trader is utilizing a variety of strategies to profit from the markets. Investors might use a variety of trading tactics that are advantageous for each distinct market rather than investing their entire cash in a single position, asset, or strategy.

How To Start Copy Trading

When copy trading, you ought to think about copying a few distinct traders.

Finding copy traders who trade on several financial products is one approach to further diversify your portfolio. One may mimic a forex trader or a commodity trader, for instance. They might also think about copying traders who work with various time frames. Within the stock market, where this approach is most popular, one may be a short-term intraday trader and another may be a long-term position trader. Additionally, traders with high return volatility relative to those with low return volatility are taken into account. Finally, one might compare extremely active traders to less active traders.

Copy trading’s business concept has the potential to be successful. The majority of copy trading companies use subscription business models, where a customer pays a charge to copy traders each month. Revenue sharing is an alternate model that may be implemented. One gets a set share of the profitable trades here.

Steps For Beginning To Copy Forex Trades

Let’s look at the steps you should take to begin replicating forex trades. In reality, everything is really simple, but I’ll do my best to explain the system in as much detail as I can so that you can profit as much as possible from utilizing it.

1. Create a Copy Trading Account

To access and duplicate the trades of professional traders across the world, you must register on the social trading site.

Register yourself here first. Registration is really simple. Set a password and enter your country, phone number, or email address. Consider creating a complicated password to ensure the security of all financial information.

Don’t use the email address you often use for social media or email because you won’t be able to use another one subsequently.

2. Pick a Trader to Copy

Using the open and resizable internet rankings, you can select profitable traders.

We can select a trader utilizing the ranking after registering by carefully watching trades. In the vertical menu on the left, select the “Copy” tab. Go to the popular menu after that. The traders with the largest managed deposits are included in this menu.

By the way, you can edit the traders’ page whatever you like. For instance, I like a tabular layout better than the cards that are shown by default. There are numerous settings available to help you select a trader.

Let’s investigate. The primary alternatives for selecting a trader are highlighted below, one by one.

Highlights

1 – Changing the tabular display mode from the card display mode.

2 – The menu where you can enable rapid trading and customize the trader’s card view. Each trader will have a copy button once this option is implemented. Try turning it on and then off. What else should I say? When using the quick trade feature, be cautious because a cat or a child could start copying without your awareness. When you click on a particular trader, you’ll see all of their details and a thorough profitability chart that you can also copy from.

3 – The “Period” option enables specifying a time frame throughout which the traders are displayed and will be classified according to particular criteria. You can select “All time” (the default value), “Today” (which won’t tell you much unless you want to know who number 1 just today is), “Last Month,” “Last Three Months,” “Last Year,” or “Last Six Months.”

4 – Grouping traders according to certain criteria, such as profitability, managed money, the number of copy traders, the length of the trading period, and trading risk level

5. “Select.” It is a multi-level filter that allows the user to completely personalize the traders they choose to set their specifications. Let’s examine it more closely. From down to up and left to right:

Copy trading’s business concept has the potential to be successful. The majority of copy trading companies use subscription business models, where a customer pays a charge to copy traders each month. Revenue sharing is an alternate model that may be implemented. One gets a set share of the profitable trades here.

Is Copy Trading Profitable?

If a trader can locate a successful trader to mimic, copy trading can produce significant profits. However, market risk is the biggest danger a trader will encounter when copy trading. A trader runs the risk of losing money if the strategy they are replicating fails. Additionally, when markets are volatile, traders suffer liquidity risk if the instruments they are dealing with encounter illiquidity. Finally, systematic hazards might arise for traders if the product they are dealing with sees sudden decreases or increases.

Visit us on : www.milliva.com