How Elliot Wave Theory Works?

![]()

How to Use Elliott Wave Theory Rules Forex trading is one of the most difficult, yet lucrative, aspects of finance.

For company owners and market analysts, connection between currencies must be define, structure as international trade becomes more interconnect.

The Elliott Wave Forex Theory in Practice

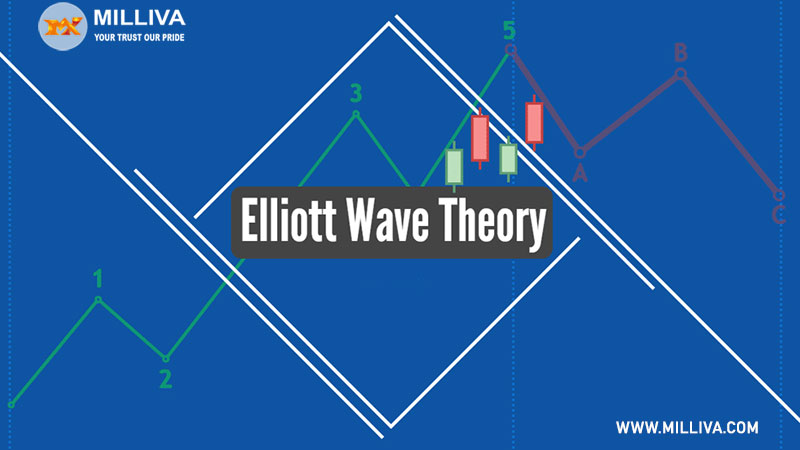

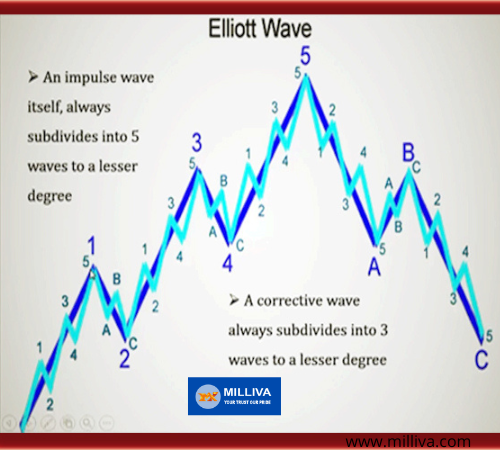

According to the Elliott Wave Theory, prices move in five distinct patterns. A five-way increase followed by a three-way decrease in an ascending trend.

A five-way collapse followed by a three-way increase in a negative trend. The five-way patterns known as ‘impulse waves,’ whereas the three-way patterns known as ‘corrective waves.’

Price gain is in phase one of the uptrend in ‘impulsive wave’. This is the point in cycle when investors expect trend to shift.

As a result, the prices have a negative denominator. Prices don’t tumble nearly as much in wave two. The trend increases in wave three, bringing favorable news into the market. Prices fall in wave four due to profit booking. Resulting in an upbeat view from investors who get favourable market news.

Elliott Wave Forex Theory for Profitability:

Every Forex trader who wants to increase the profitability of their business has to understand Elliott Wave Theory.

It’s utilised to figure out the market’s trend, as well as the rise and fall of currency value

Profitably employing the Elliott Wave Forex Theory is a fantastic place to start learning the secrets of the trade . Technical ideas may not be fully presented in a single session and may require more research.

It has advantages and disadvantages but the problem is determining how to make its core benefits matter.

It’s worth noting that Elliott Wave analysis should only be used as a back-up measurement

Nonetheless, it is an excellent instrument for enhancing and enriching your trading technique. It might be used to identify stop-loss orders and forecast the intensity of potential market swings.

The EW oscillator works well when paired with indicators like the MACD and RSI. Since these combinations allow traders to accurately identify their exit and entry positions.

When using Elliott Wave Theory in Forex trading, the principles are quite similar to those used in stock trading.

The primary difference is that stocks are considerably more difficult to short. But with Forex trading, you can really go short on the trading instruments. Allowing you to benefit from this oscillator much more.

Elliott Wave Trading’s Benefits:

The Elliott Wave Theory provides usefulness as a diagnostic tool for spotting prospective trade opportunities by offering a structure for arranging price movement information into easy-to-understand, graphical representations. Even novice traders can start using this theory to inform their tactics if they have a good comprehension of the rules.

At the same time, Elliott Wave trading’s popularity is an advantage: because it is based on consumer psychology, its relevance to forex trading is stronger when a large group of traders is watching these patterns and trading based on them.

Elliott Wave Trading’s Drawbacks:

Despite its benefits, the Elliott Wave Theory has limits that might cause problems and lead to incorrect findings during trade analysis. Unlike Fibonacci patterns and comparable techniques, which provide traders with specific ratios and thresholds to watch for, Elliott Wave Theory is more subjective in its pattern identification.

The price fluctuations that define the start and conclusion of a wave might differ from one trader’s interpretation to the next, thus traders must detect these patterns on their own. As a result, some detractors claim that this approach is too arbitrary to provide consistent trading advise.

Furthermore, the patterns themselves may become so constructed in the trader’s mind that they lose touch with the real-world forces that drive price fluctuations. Traders frequently utilize Elliott Wave trading in conjunction with other oscillators, such as the relative strength index and average directional index, to overcome these restrictions.

Traders may have more faith in trade recommendations when Elliott signals match the indicators provided by these instruments.

Visit us on: www.millliva.com

Elliott Wave Theory - Overview

26th Aug 2022[…] collapse of mass psychology followed the same predictable patterns; he dubbed these patterns ‘waves.’Elliott was able to analyse and understand the market to a far higher degree owing to its fractal nature, […]