How To Make Money in Forex Trading

![]()

Foreign exchange helps the investors to trade any currency in the globe partially. Forex brokers like Milliva are the trading platform. You must be aware when you are making money in forex; you are accepting a speculative risk. You’re wagering that the price of one currency will rise in relation over another.

When you’re currency trading it will have a comparable anticipated return to the money market and is less risky than equities or bonds. On the other hand leverage is used to boost rewards and risk. Active traders are believed to make more money than passive traders in currency trading.

Understand the Basics in Forex

Trading Platforms like Milliva –best forex broker in India provides sufficient basic knowledge to the users and beginners. The basics in forex such as

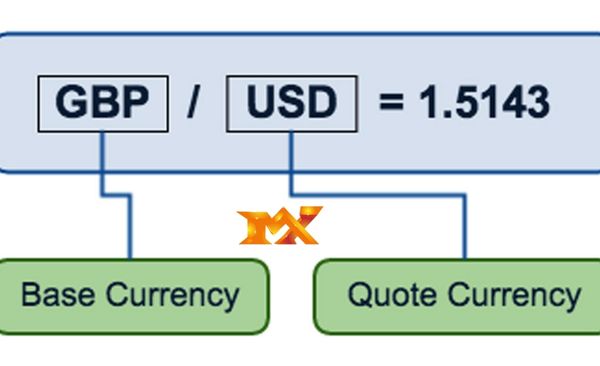

Base and quote currency

Base Currency

The base currency is the 1st currency of the pair that you buy.

Quote Currency

The quote currency is the 2nd currency of the pair that you pay in amount to buy the base coin.

For example in EUR/USD, EUR is the base currency and USD is the quote currency. To buy EUR coin you have to pay the amount in USD. That is to buy 1 EUR coin you have to pay $1.35 USD currency.

Long and Short

Long

Decide whether you want to buy or sell. If you want to buy (which implies you want to buy the base currency and sell the quote currency), you want the base currency to appreciate in value so you can sell it back at a higher price. This is known as “going long” or having a “long position” among traders. Just keep in mind that long equals buy.

Short

If you wish to sell (that is, sell the base currency and buy the quotation currency), you want the base currency to depreciate in value so you can buy it back at a reduced price. Going “short” or assuming a “short position” is what this is referred to as. Just keep in mind that short equals sell.

Flat to Square

If you don’t have any available positions, you’re described as “flat” or “square.””Squaring up” is another term for closing a position.

Bid Ask and Spread in Forex Trading

Bid

Your broker’s bid is the price at which he’ll purchase the base currency in return for the quotation currency. This implies the bid is the best price possible for you (the trader) to sell to the market. The broker will buy anything from you at the bid price if you wish to sell it.

Ask

Ask refers to the price that your broker will sell the base currency in exchange of quote currency, which means this signifies that the requested price is the best accessible price on the market. Offer price is another name for ask. If you wish to buy anything, the broker will sell it to you for the requested price

Spread

The difference between the bid and the ask price is called as spread. The bid price on the EUR/USD rate above is 1.34568, while the ask price is 1.34588. Take a look at how easy it is for you to exchange your money with this broker. If you wish to sell EUR, you may do so by clicking “Sell” and selling euros at 1.34568. If you wish to buy EUR, click “Buy” and you’ll get 1.34588 euros. The best forex broker in India provides spread from 2 pips for standard Account, from 3 pips for Elite Account, from 0 pips for ECN Account and from 0 pips for Premium Account.

Visit us: www.milliva.com

Forex trading with zero investment

08th Jul 2022[…] your money in order to receive such benefits. There are various forex brokers that offer free real money for trading, which is known as a no deposit bonus. This is a gesture of welcome to new clients on their trading […]