How to Trade – Piercing Pattern Candlestick in Forex Trading

![]()

The vast array of different methods available to traders is one of the reasons why technical analysis continues to be such a popular method of analyzing and trading the markets. Traders can experiment with different methods. Such as reading raw price action, chart patterns, and indicator analysis, until they find one that works for them. We’ll talk about an important candlestick pattern in this article. We’ll learn how to recognize and trade the Piercing line candlestick pattern in particular.

What is Candlestick in Forex Trading?

Candlestick reading is one aspect of technical trading that offers a diverse and exciting set of options. Technical analysis relies heavily on candlestick reading. There are many options available when it comes to candlestick reading, ranging from individual candlestick analysis to complex candlestick patterns. The piercing line pattern is a mid-level candlestick formation that will be discussed in this article. However, before we look at this pattern and how to trade it. Let’s make sure why it’s so important and useful to traders.

The shape and size of candlesticks reveal a lot about the underlying order flow action during that session. A large green candle indicates that there was a lot of buying during that session. Because the price closed much higher than it opened. A large red candle, on the other hand, indicates that there was a lot of selling during that session. Because the price closed much lower than it opened.

What Is the Importance of Candlesticks in Forex Trading?

Candlesticks are one of the most widely used methods for displaying price data on trading charts. The reason for their popularity is that they provide a very quick visual guide with a lot of useful information.

Candlesticks are a great way to see what’s going on with the market’s underlying order flow. Candlesticks, at their most basic level, tell us four things about the price movement during that session. The open, the high, the low, and the close are the four points on the chart. A red candle indicates that price ended the session lower than it began. While a green candle indicates that price ended the session higher than it began.

What is Piercing Pattern in Forex Trading?

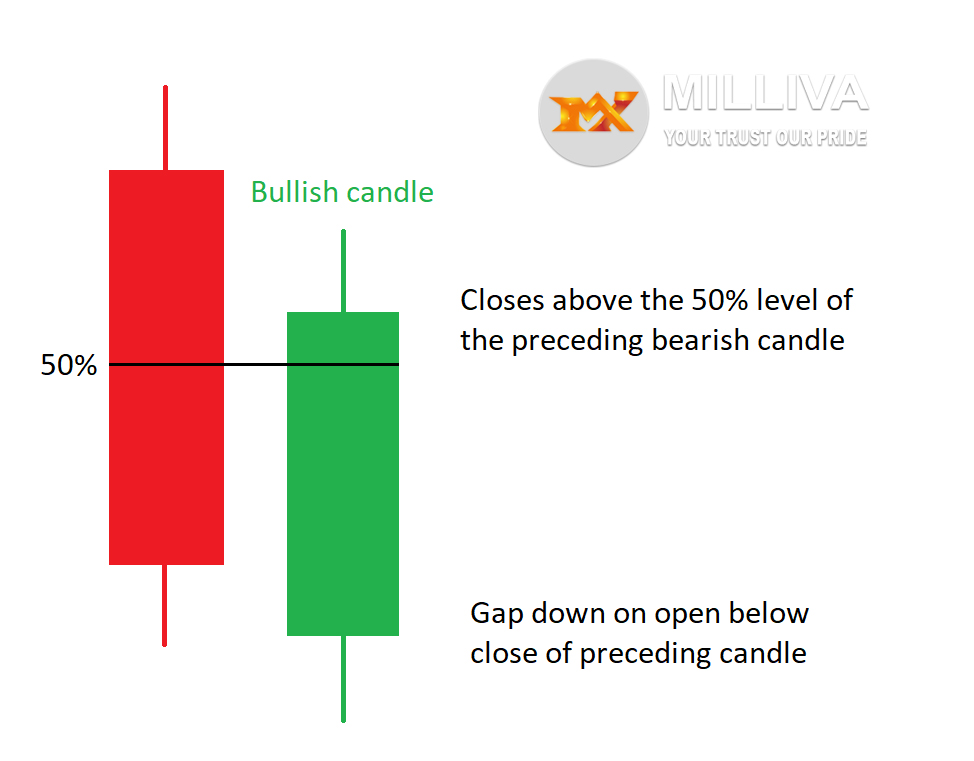

A piercing pattern is a two-day candlestick price pattern. It indicates the possibility of a short-term reversal from a downward to an upward trend. The first day of the pattern has an average or larger trading range. It opens near the high and closes near the low.

It also includes a gap down after the first day’s trading. With the second day’s trading starting near the low and ending near the high.

The close should also be a candlestick that covers at least half of the red candlestick body’s upward length from the previous day.

How to Trade with Piercing Pattern in Forex Trading?

To trade this pattern. We can place a buy order when the price breaks above the high of the bullish candle. Our stop goes below the low of the entry candle. Then, to ensure a positive risk-reward ratio, we aim for a target that is at least twice our risk.

This pattern’s beauty is that it serves as an early warning sign of a possible bullish reversal. Furthermore, because the market is moving lower at the time the pattern occurs. This trade idea would not occur to you unless you are trained in candlestick reading and are familiar with this pattern. As a result, it can be a great way to gain a unique market entry point that only a few traders are aware of.

One of the most appealing aspects of candlestick reading is this. You will frequently find that you are able to gain a better entry point to a move as you learn to analyze the raw price action and what it tells you about the underlying order flow in the market.

Trade with Bearish Trend

If you are looking at a bearish trend and waiting for price to break above a trend line. In order to enter a bullish reversal trade, you will often find that you are getting in late in the move. Learning to read candlestick patterns like this one, on the other hand, allows you to be much more responsive to and in tune with market changes.

Knowing this pattern can help you the market’s underlying order flow action. We can establish a buy position based on a solid trading premise by understanding the shift that must have occurred in order for this candlestick pattern to form. And we’ll be able to do so relatively soon. This gives us a much tighter stop, which means that if we want to decipher keep our trade open, we can potentially secure a much larger profit if we use a trailing stop method.

We can now look to use this pattern in conjunction with other technical elements, rather than just trading it as a stand-alone system. Convergence of technical methods is one of the most effective ways of analyzing and trading the market because it increases our chances of success with our trade idea.