How to Trade with Three White Soldiers Candlestick Pattern in Forex Trading

![]()

Following a downtrend, the three white soldiers candlestick pattern indicate a steady advance of buying pressure. Bullish patterns like these frequently indicate a price reversal. When they see the three white soldiers pattern, some traders consider opening a long position to profit from any upward trend.

What exactly is Three White Soldiers?

Three white soldiers candlestick pattern is a bullish candlestick pattern that predicts the reversal of a pricing chart’s current downtrend. Three consecutive long-bodied candlesticks open within the previous candle’s real body and close above the previous candle’s high make up the pattern.

The shadows of these candlesticks should be short, and they should open within the real body of the preceding candle in the pattern.

What Can You Learn From Three White Soldiers?

The three white soldier’s candlestick pattern indicates a significant shift in market sentiment in terms of the stock, commodity, or pair forming the chart’s price action. When a candle closes with little or no shadows, it means the bulls were successful in keeping the price at the top of the range for the session

Essentially, the bulls take control of the rally for the entire session and close near the day’s high for three sessions in a row. In addition, other candlestick patterns that suggest a reversal, such as a doji, may precede the pattern.

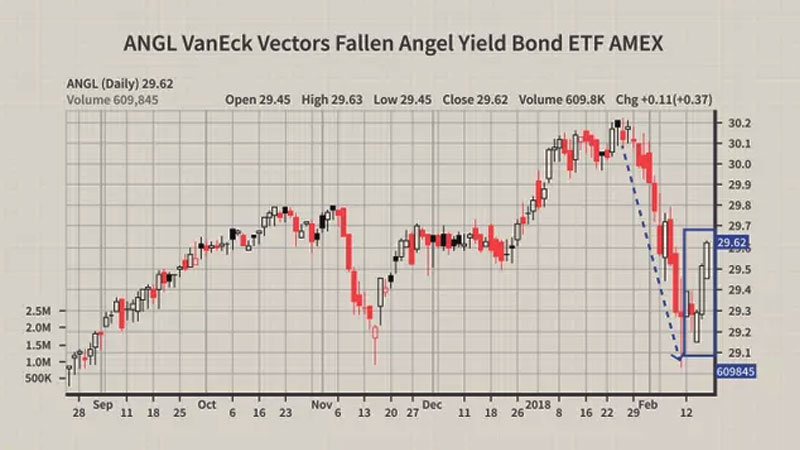

Here’s an example of three white soldiers candlestick pattern in a VanEck Vectors Fallen Angel High Yield Bond exchange traded fund pricing chart (ETF)

Before the three white soldier’s pattern marked a sharp bullish reversal, the ETF had been in a strong bearish downtrend for several weeks. Although the pattern suggests that the rally will continue, traders should consider other factors before making a decision.

For instance, the stock could have reached a point of resistance, or the move could have been on low volume.

How to trade with pattern of three white soldiers

Look for three consecutive green or white candlesticks to identify the three white soldier’s pattern. Each one must open and close at a higher level than the first. Candlesticks with large bodies and very small (or no) wicks should be used. As previously stated, the pattern is most likely to be seen at the bottom of a downtrend.

Three white soldiers candlestick pattern in the foreground are a good example.

Assume you’re tracking the GBP/USD rate, which starts the day at $1.23723. The price begins to move as more buyers and sellers enter the market. It drops to a low of $1.23657, but buyers put the market under pressure, and the pair rises to a high of $1.24293 before closing at $1.24211.

The bulls continue to push the price higher the next trading day, reaching a high of $1.24958 before closing at $1.24873. On the third trading day, buyers managed to push the GBP/USD price up to $1.25494, before closing at $1.25388.

The three white soldier’s candlestick pattern is formed by these upward moves over the trading period, as shown below.

When you see the three white soldier’s pattern, how do you trade?

When you see the three white soldier’s pattern, you can trade in a variety of ways. First, use technical indicators like the stochastic oscillator or the relative strength index to confirm the signal (RSI). Because indicators can provide more insight into price trends, this can help to validate what the candlesticks are signaling.

If you see three white soldiers at the bottom of a downtrend and believe a reversal is on the way, you can use the RSI to test the signal. Because it tracks the market’s speed and momentum, this indicator can help you predict price trends. You may want to open a long position if the reversal is confirmed (buy).

You can use derivatives like spread bets or CFDs to trade when you see the three white soldier’s candlestick pattern. Because you don’t own the underlying assets, you can trade rising and falling markets with these financial products.

When you see the three white soldiers chart pattern, follow these steps to trade:

1.Create a new account or sign in to an existing one.

2.In the search bar, type the name of the asset you want to trade.

3.Fill in the size of your position.

4.In the deal ticket, select ‘buy’ or ‘sell.’

5.Confirm the transaction.

The three white soldier’s pattern is a bullish candlestick formation made up of three green or white candles that each close higher than the previous one. The pattern is most likely to be seen at the bottom of a downtrend. The three white soldiers indicate a steady increase in buying pressure, which could indicate an impending price reversal.

You can use derivatives like spread bets or CFDs to trade when you see the three white soldier’s candlestick pattern.

Visit us on: www.milliva.com