Manager of Moriarti’s Famed PAMM Account about Trading.

![]()

Many individuals are aware that the Alpari PAMM account service has added a new record to its database. One of the PAMM accounts had a 166,700 percent return. This outcome was reached by the management during the course of the account’s 5-year history.

But owing to large-scale market volatility and the proper approach, the manager experienced a dramatic surge in profitability of nearly 300 percent in the last few of weeks of March 2020. This is more proof that, at a period of global financial market volatility, investment in PAMM services may result in big profits.

How Can you Maintain Your Trading Success Over Such a long Period of Time?

In 2003, I was initially introduced to trading and financial markets. Since then, I’ve never stopped trading. I began with a demo account, but after a month, I upgraded to a fully paid account with a little sum. I traded effectively for almost three years utilizing a rigid method and little amounts. After gaining trust in the trading strategy I was utilizing, I became an Alpari client in 2007 and moved all of my trading there while concurrently raising my deposit.

However, in line with Sod’s Law, after a few months, I began to make psychological errors and ceased adhering to my method as closely as possible. As a result, I lost all of my funds, totaling around $10,000 USD, which was sum of substantial money at the time. In this regard, I went through a lot of stress and a personal crisis that lasted several months. I continued to trade on the demo account in the meantime, trying to learn from my mistakes.

Went back to sponsored accounts after a time. I began experimenting with various trading tactics, with variable levels of success. Some businesses prospered, while others struggled. Then I became intrigued with PAMM accounts and wanted to put my previous experience managing investor cash to use.

I understood that support and resistance levels are the finest technical indications, and that I needed to design a strategy around them. I launched the Moriarti account at the end of 2014, where I traded using channels constructed around critical levels. Over the course of a few years, I gradually ditched the channel method in favour of focusing on key support and resistance levels. In addition, I enhanced my system with additional basic analysis.

When the Downturn Began, What Feelings did you Feel?

Any decline is unpleasant to experience, especially when it occurs suddenly. The number of open positions was tiny at the start of the precipitous decrease, so I didn’t think it was a big deal. There were also available spots on other instruments, so I was at ease. However, on the 18th of March, the GBPUSD pair had an unexpected 600-pip decline.

Given the severe drop of 1,000 pips in the preceding days, I believe few people predicted such a quick collapse of one of the world’s top currencies. This, however, did not occur. Meanwhile, by the end of the day, the downside had reached roughly 50%, and it proceeded to rise over the next several trading days. Investors were extremely concerned, and anxieties were running high.

How did you Overcome the Situation and Reclaim Your Position?

Following a loss on the GBPUSD pair in the following trading days, I turned to gold. I expected the negative trend that had developed during the previous week to continue. But I was mistaken once more. Another failed trade resulted in an approximate 85 percent loss.

I slashed my losses and returned to the pound. I began to believe that full recovery would be difficult, but I tried not to think about it and instead focused on the next deal. Even with a 99 percent downturn, we should remember that there is always a possibility to rebound. That concept, I suppose, aided me in some way. Everything wasn’t feasible to get out of this unpleasant circumstance right away, but it happened more faster than I anticipated.

Surprisingly, I was able to recoup owing to the GBPUSD pair, as I took advantage of the pair’s strong volatility over the next few days. The PAMM account saw tremendous growth and a new all-time high after a string of successful deals.

What Kind of Trading Tactics do you Employ?

I don’t follow a specific entry and exit plan while trading. Also I use support and resistance lines, as well as 4-hour and higher charts, to begin and close trades. I usually start my trades on a rebound from these levels. The more trustworthy the signal and the greater the position with which I join the market, the longer the line is timewise and the sooner it starts.

For long-term deals, I also employ fundamental analysis. In challenging situations, I try to find my sentiments based on what’s going on and my trading history. I’ve been working on funded accounts since 2003, and I evaluate quotations and charts on a regular basis, as I indicated before. Over the previous 17 years, I may have developed a type of market sixth sense. This seemed to assist me in the most trying of circumstances.

How Much of Your Time do you Devote to Trading? Describe your Normal Working Day.

On my PAMM account, I usually open long-term transactions that may not be closed for several months. In typical trading, I attempt to remain as long as possible in the trend and make the most of a single high-quality signal. As a result, I don’t spend a lot of time at the trading desk.

This is more of a psychological issue than a trading one. It’s critical to learn to wait and not jump out of positions before they’re ready. In challenging situations, I frequently alter my strategy and go into active mode. In this instance, I put everything else aside and focus solely on trading.

Do you feel Pushed Since you’re in Charge of such a Large sum of Money? What Techniques do you Employ to Cope with Stress?

Of course, the greater the amount of money under management, the greater the manager’s obligation. Psychological stress is always present, especially during recession periods. It’s critical to keep your emotions in check and make only well-informed business judgments.

During times of heavy drawdown, the pressure rises dramatically, and the number of unpleasant posts directed at the management rises on the forum. I make an effort to solely listen to helpful comments. There are also trade suggestions and market projections, which might influence the manager’s trading decisions.

Because the manager is always accountable for the PAMM account, it’s critical to keep to your strategy. You must be able to deal with the stress that comes with handling a hefty deposit. Sports are beneficial to me in this regard. I do cross-country skiing several times a week in the winter and prefer exercising outside in the summer.

What is the Best Approach to Learn Trading if you are a Beginner?

First and foremost, you need create a practise account. It’s critical to become familiar with the trading terminal, learn how to start and cancel trades, place limit orders, and understand all of the complexities. All actions that you can automate should be done so. You should feel as if you’re swimming in water.

After you’ve completed this first setup, you may immediately begin studying trading. I’m not going to recommend any books because you’re unlikely to learn anything from them. Trading forums, webinars, and training courses, on the other hand, are what I advocate. Start experimenting with different trading techniques right now. It’s critical to select one that you enjoy.

Try it out on a demo account with different indicator parameters. It’s not a good idea to utilise a lot of indicators at once – no more than two or three at a time. There are several trading techniques to choose from, so it’s critical to select one that you’re comfortable with. It’s also crucial to put your plan to the test using previous data.

You should do this for at least the previous 5 years, if not more, and observe how your method performs. If everything looks OK to you, try it out on a real account with a little deposit. However, in trading, this is not the most significant factor. This is merely the beginning. Then there’s psychology to consider. You must follow the specified guidelines. In truth, the most challenging aspect of trading is maintaining psychological stability.

Traders are driven by fear and greed, and it’s critical to learn to handle these emotions. However, this is the next level of growth, which can only be learned by those who are self- discipline.

Exceptional success stories, such as the one shared by today’s interviewee, serve as a source of motivation for investors all around the world. Join us now to make the most of your money!

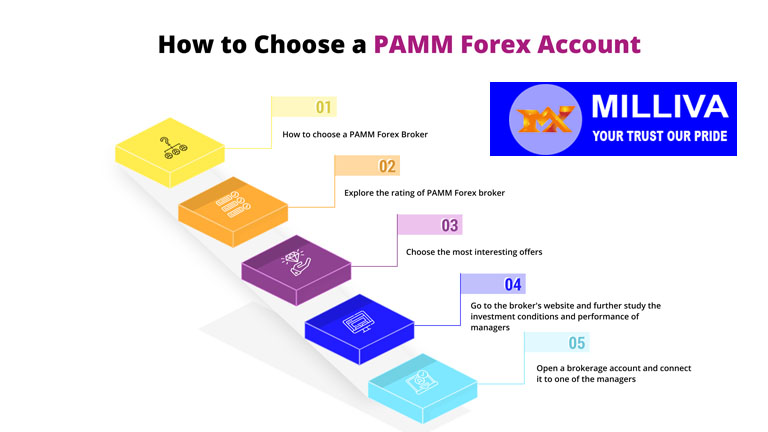

PAMM Account In Milliva:

The Best forex broker in India has a PAMM Account, Percentage Allocation Money Management is shortly referred to as PAMM. This kind of trading setup lets users allocate funds to a qualified trader or money manager they pick, who in turn controls these pooled funds across various trading accounts. By using Milliva’s PAMM solutions you will be traded in the best platform for trading and which are ideal for money managers searching to manage funds across numerous client accounts using one single Master Account and interface.

Visit us on: www.milliva.com

wkibbtvr

09th Jun 2022https://erythromycinn.com/# erythromycin for fish tanks

What is a PAMM Forex Platform? How Does it Work?

27th Jul 2022[…] broker provides a Limited Power of Attorney (LPOA) document, which both parties sign, giving the Money Manager the right to manage the investors’ money under agreed-upon terms and conditions. The […]