What is the Forex Swap and Types in MetaTrader 5 In forex

![]()

Swaps in MetaTrader 5 or mt5 swap are derivative instruments. That represent a two-party agreement to exchange a series of cash flows over a specific time period. Swaps provide a great deal of flexibility in terms of designing and structuring contracts based on mutual agreement. This adaptability results in numerous swap variations, each serving a specific purpose.

What is a Swap in MetaTrader 5?

A swap is a two-party derivative contract that involves the exchange of pre-agreed-upon cash flows from two financial instruments. The notional principal amount commonly used to calculate cash flows (a predetermined nominal value). Each cash flow stream referred to as a “leg.”

Swaps relatively new type of derivative, having been introduce in the late 1980s. Despite being relatively new, their simplicity, combine with their wide range of applications.It makes them one of the most commonly trade financial contracts.

Swap in MetaTrader 5 contracts can used by corporate finance professionals to hedge risk and reduce the uncertainty of certain operations. For example, projects may exposed to exchange rate risk at times, and the CFO of the company may use a currency swap contract as a hedging instrument.

Swaps, unlike futures and options, traded over-the-counter rather than on exchanges. Furthermore, because there is always a high risk of counterparty default in swap contracts. Swap counterparties are usually companies and financial organizations rather than individuals.

Typically, some financial institutions act as market makers in swap markets. The institutions, also known as swap banks, make transactions possible by matching counterparties.

Types of Swaps in MetaTrader 5

Modern financial markets use a diverse range of derivatives for a variety of purposes. The most common types are:

Interest Rate Swap

Counterparties agree to swap one stream of future interest payments for another based on a fixed notional principal amount. Interest rate swaps, in general, involve the exchange of a fixed interest rate for a floating interest rate.

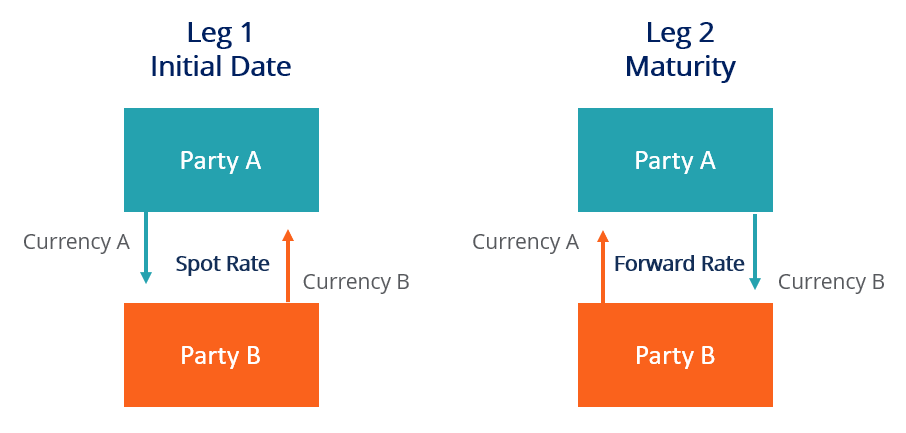

Currency Swap

Counterparties exchange principal amounts and interest payments in various currencies. Swap contracts frequently used to protect another investment position from currency exchange rate fluctuations.

Commodity Swap

These derivatives intended to exchange floating cash flows. Based on a commodity’s spot price for fixed cash flows based on a pre-agreed commodity price. Contrary to popular belief, commodity swaps do not involve the exchange of actual commodities.

Credit Default Swap

A CDS protects against the default of a debt instrument. The premium payments transferred to the seller by the buyer of a swap. If the asset fails, the seller will reimburse the buyer for the asset’s face value, and the asset will transferred from the buyer to the seller. Credit default swaps gained notoriety as a result of their role in the 2008 Global Financial Crisis.

Rate of Swap in MetaTrader 5

To view swap rates in MetaTrader 5, you must first download it, which you can do for free by clicking the banner below!

Swap rates found in your MetaTrader trading platform. The swap of an open position in both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms under the “Swap” column of the “Trade” tab, as shown below.

It’s found prior to opening a position by right-clicking the instrument in the “Market Watch” window. Simply select “Specification” from the subsequent drop down menu to open a dialogue box containing information about the instrument, including swap values.

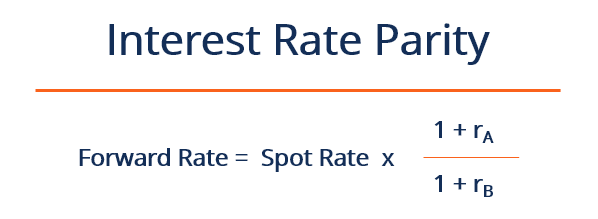

How Can the Swap Rate Be Calculated?

Calculations for forex swaps can occasionally be somewhat difficult, depending on your broker. At Admirals, you can quickly determine the swap rate for your deal as well as other crucial information by using our trading calculator.

The contract specification page for the trading instrument will list the swap rate, which varies based on the broker you use.

The Forex swap charge is displayed in connection to the pip value of your position on the Admirals contract specification pages.

We learned via the trading calculator that the example position’s pip value was 7.66 GBP. Our long (buy) swap value equals -3.29 GBP after multiplying that by -0.430, and our short (sell) swap value equals -2.14 GBP after multiplying it by -0.280.

In the event that broker displays their swap rate to you as a daily or in annual percentage. You must determine the swap value using the nominal value of your position.

You must calculate percentage value of your nominal position. If it is presented as an annual percentage before dividing it by 365 to get the daily amount.

The amount of the swap is dependent on the financial item you are trading, as we have already mentioned. Depending on your stance, it may also have a good or negative rating. In this case above both numbers were negative indicating that the trader has been penalized for holding position overnight regardless of the decision made.

The underlying interest rates for the currencies in the trading pair have a significant impact on the Forex swap rate. Additionally, exchange rates include a custody cost. Negative swaps are typically seen for both long and short positions. When costs of holding an asset are high (like with commodities).

Visit us : www.milliva.com