Money Management : How To Make Money in Forex

![]()

If you are skilled in everything else but not in money management, you could lose everything on your trading account. What steps can you take to enter the market, stay there, and make money through money management? See what follows.

Unfortunately, effective money management is frequently a habit. If you were unfortunate enough to miss learning this important financial lesson early in life. You definitely struggle with excessive spending and a lack of savings. It is evidently a significant issue for a trader or investment. The good news is that you can develop this habit at any time.

We analyzed the most popular money management strategies. And picked the most valid tips for those who want to maximize their investment effort.

For your comfort, we split them into 2 categories: survival tips and profit tips. The key is that the technique for newcomers to Forex built on survival. You must first remain secure and floating before focusing on making money. This is how it goes.

Money Management forex Techniques

#1 Survive

This is a #1 tip for anyone who is getting start on Forex. You need to be aware of how much money you’re willing to risk on a single trade. Your maximum risk per trade should typically not exceed 2% of your trading account. To determine how profitable a given deal can be, it is a good idea to use a trading calculator.

Don’t want to end up placing string of losing orders blowing up your entire balance risk management is essential.It is good idea to use stop-losses for each and every trade.

It will safeguard your investments from unpredictable market moves: just set your stop-loss order not to exceed more than 2 percent of your trading balance, and you will stay on budget regardless of the stormy market.

Depending on what you need to balance, you can try equity stops, volatility stops, chart stops (technical analysis), or margin stops.

Manage Your Feelings

Don’t let your emotions rule your actions. Traders are frequently told as this is what drives. The majority of newbies away from the market before they even realize their first gains. Your deadliest enemies will be stress, tilt, and greed, so make sure you understand how to deal with them (for example, here).

An emotionally unstable trader would frequently move stop-losses while a transaction is already open, close out positions early, or use excessive leverage.

Profit

Although leverage is the best way to increase profits, it should still used with caution. It comes with more dangers in addition to the possibility to improve your profit. High leverage is generally not the best strategy for a beginner, but after you gain confidence, it can result in the fantastic gains you had in mind when you first entered the Forex market. In order to prevent huge losses, take your time deciding on your trade size and leverage based on the stop-loss in pips.

Set the Proper Take-Profit Levels

Your ability to respond quickly can be the difference between success and failure while trading forex. Take-profit levels are all about knowing where to liquidate your trade in advance as it becomes profitable, in particular.

In Conclusion

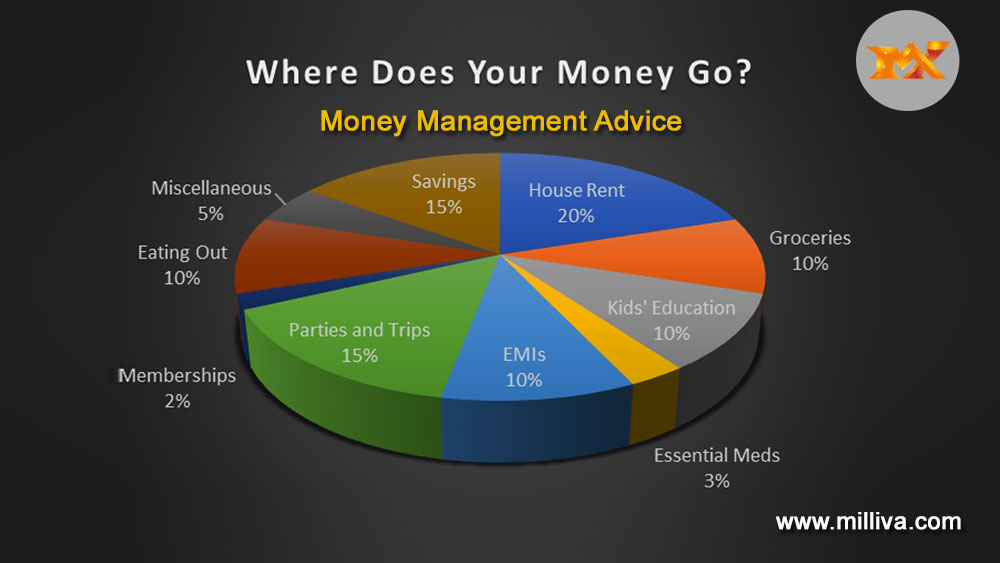

Let’s face it: maintaining your finances can occasionally be more difficult than earning income. Over time, bigger earnings are generated by the prudent management of your savings. Do not be alarmed; everyone makes financial errors that leave us wondering where our money went.

Just be sure to follow the proper procedures in order to get through your initial months, learn the mechanisms and experiment with the strategies (you can find everything you need in our Analytics and Education section), and make as much money as you had originally anticipated when you first started trading forex.

Visit us on: www.milliva.com

What is a PAMM Forex Platform? How Does it Work?

27th Jul 2022[…] account manager may Make Money from their own trading and retain a portion of the gains from the funds they oversee. When trading […]

Forex Trader- Technique "I Wish I Know this Earlier"

31st Jul 2022[…] how much we can make. Forex trading is a good example of how the adage “It takes money to Make Money” is […]

Why Being A Lazy Trader Will Make You Profitable - Milliva

01st Aug 2022[…] forced. You might as well stop caring, become more at ease, and let the market take care of itself. Making money in trading is not a matter of “if,” but rather of “when,” if you have […]

Should You Trade the Trend or the Range in Forex?

02nd Aug 2022[…] trading obviously calls for a whole different method of money management. Range traders prefer to be wrong at first in order to construct a trading position rather than […]

Tips To Make Money During Black Friday Economy

05th Aug 2022[…] goal is for retail enterprises to make enough sales on this Friday (and the following weekend) to Make Money for the rest of the […]

5 Best Tips for Better Money Management in Forex

05th Aug 2022[…] Money management for forex traders, on the other hand, is solely concern with how to use your money to increase your account balance without putting it at danger. […]

Understanding How Social Trading Works

02nd Sep 2022[…] a significant amount of money when they first enter the market. This allows even novice traders to make money by following more experienced […]

Guide to Build a Personal Financial Plan

09th Sep 2022[…] you meet with a financial advisor, they’ll be sure to ask you whether you have a 401(k) or other employer-sponsored retirement […]