What are FX Options? | How to Trade Currency Options

![]()

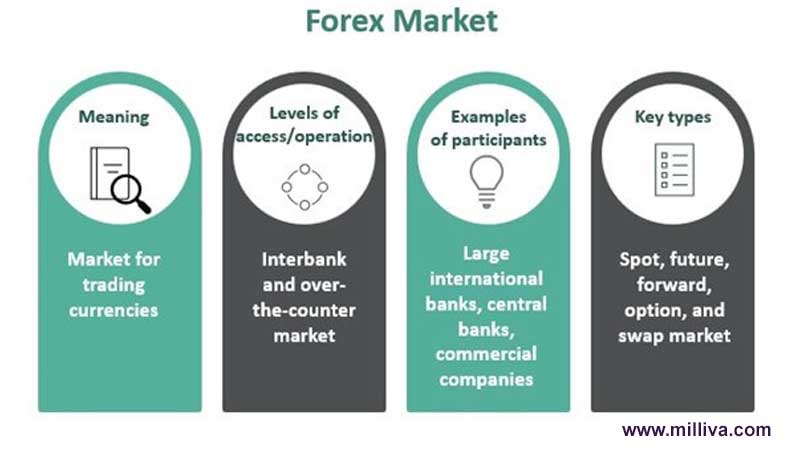

What Exactly is Forex Option market?

Derivatives based on underlying currency pairings are forex options market. There are also many different trading methods for forex options used in the forex markets. Where foreign currencies traded. The type of option a trader selects and the broker or platform. Where it is available have a significant impact on the strategy they can use.

The decentralised forex market, which varies significantly more than options in the more centralized stock and futures exchanges. It is one of the characteristics of currency options trading.

How Forex Option Market Works?

Similar to how you would evaluate equities options, FX option traders can utilise the “Greeks” (Delta, Gamma, Theta, Rhio, and Vega) to assess the risks and rewards of the options pricing.

The risk for an option buyer constrained to the ‘premium,’ which serves as the option’s purchase price. The potential profit for an option buyer is theoretically limitless. For an option seller, however, the risk may unlimited, but the reward restricted to the premium paid.

Why Do You Trade Forex Options?

For short-term hedges of spot FX or foreign stock market holdings. FX options are one of the most frequently used instruments. For instance, if you were buying EUR/USD but believed the price may drop temporarily, you could also buy a euro put option to profit from the drop while keeping your buy position. Additionally, you might buy and sell short EUR/USD at the same time.

Options contracts used to implement a variety of optimistic, bearish, and even neutral strategies. The same spread tactics that employed with equity options, such as vertical spreads, straddles, condors, and butterflies, used with FX options.

Either buying or selling an FX option is possible. The base currency, which is the first currency in the currency pair (for example, euros in EUR/USD), is where options pricing are derived. You should purchase calls or sell puts if you are bullish on the base currency, and buy puts or sell calls if you are bearish.

Visit us on: www.milliva.com

What is the Important Factors in Forex Trading Exit - Strategy

14th Jul 2022[…] Finally, there is one exception to this multi-tiered approach. It’s our responsibility to select the low-hanging fruit when the market gives out presents. […]