Range Trading – A Simple Strategy Explained

![]()

Naturally, all traders look for the best technique in Best Forex Brokers In India to help them achieve their trading objectives. Limit trading is an increasingly popular approach in the market as more and more people see it as a way to take advantage of what the forex market offers. For some, the idea of margin trading, or even the word itself, is foreign. But that is about to change. In this blog, you can learn about breaking down range trading and explain what’s behind the strategy and how you can implement it.

What Is Range Trading?

Range trading is a forex strategy that identifies overbought and oversold currency (also known as areas of support and resistance). Range traders buy during oversold/support periods and sell during overbought resistance periods.

Range trading can generally be executed at any time, but it is most effective when there is no long-term trend and direction in the forex market. Range trading can be weak during a trending market, especially if directional market bias is not considered. 2017 was an excellent year for range traders because currency markets were sideways.

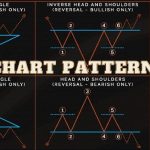

Types Of Range

To become a successful range trader, you need to have a solid understanding of the types of ranges that stand behind the strategy. Here are four of the most common types of limits you’ll see.

Rectangular Range:

When you encounter a rectangular range, you will see sideways and horizontal price movements between lower support and upper resistance. This is common during most market conditions but less common than series limits or channel limits.

Pros: Rectangular ranges represent periods of consolidation and have a shorter duration than other range types, leading to faster trading opportunities.

Cons: These ranges can mislead traders who are not looking for long-term patterns that can influence the development of a rectangle.

Diagonal Range:

Diagonal ranges in the form of price channels are common forex chart patterns, and many range traders take a preferential interest in them. The chart below illustrates a descending diagonal range that establishes highs and lows to help identify a potential breakout of this range in the Best Forex Trading Platform In India.

Pros: With diagonal ranges, breakouts occur on the opposite side of the trending movement, giving traders an edge in anticipating flights and taking profits.

Cons: Although many diagonal range breakouts happen relatively quickly, they can develop over months or years, making it difficult for traders to decide when to expect a flight.

Continuation Ranges

Continuation ranges are chart patterns that extend within trends. These ranges typically occur as corrections against more significant trends, such as triangles, wedges, flags, and pennants. A triangle forms in the middle of an existing price trend, resulting in a period of consolidation within a tight range.

Pros: Consecutive limits can often occur amid ongoing trends or patterns. They often result in a quick breakout, satisfying traders who want to open a position and take a quick profit.

Cons: Because continuous patterns occur within other trends, there is added complexity in evaluating these trades and accounting for all the variables at play. This can make streak limits a little tricky for new traders.

Irregular Ranges

Most ranges don’t need an obvious pattern at first glance. When a particularly irregular range emerges, it takes place around a central center line, and resistance and support lines form around it.

Pros: Irregular ranges can be an excellent trading opportunity for traders who can identify the lines of resistance that form these ranges.

Cons: The complexity of irregular ranges means traders must use additional analytical tools to identify these ranges and potential breakouts.

The Strategy behind Range Trading

Many active traders pursue range trading. Aspirants need to understand the types of limitations they face and the strategy to take full advantage of them.

Range Identifying

You must identify the trading range to start on the right foot. After a coin is recovered from the support area, it can be detected at least twice. The currency must have bounced back from the resistance area. These highs and lows don’t have to be precisely the same, but they should be close.

Set Up Your Entry

With the trade limit on your crosshairs, you should set your entry. This can be done by placing buy orders near support levels and sell orders near resistance levels. To help with this, some people use indicators to place trades.

Manage Risk

Finding your range and setting your entry is the final part of any effective range trading endeavor that you should never forget. Risk management is always an important factor, no matter how you choose to trade, but it becomes even more critical when you decide to control the trade in Top Forex Brokers In India.

Visit us at: www.milliva.com