Single Candlestick Pattern – A Guide

![]()

What is Candlestick?

A candlestick is a graphical representation of price movements within a specific period in financial markets. The Best forex Broker in India provides sufficient knowledge for traders. Candlestick provides information about the open, close, high, and low prices for a given period, typically displayed as a single bar or “candle” on a price chart. Each candlestick contains four important components:

Open: The open price represents the first transaction price at the beginning of the period.

Close: The close price represents the last transaction price at the end of the period.

High: The high price indicates the highest transaction price reached during the period.

Low: The low price indicates the lowest transaction price reached during the period.

The open and closed prices determine the candlestick’s body, while the thin lines above and below the body are called “shadows” or “wicks.” The upper shadow represents the high price, and the lower shadow represents the low price.

The color of the candlestick can vary depending on how the close price compares to the open price. Traditionally, a bullish or positive candlestick is represented in green or white and occurs when the close price exceeds the open price. Conversely, a bearish or negative candlestick is represented in red or black and occurs when the close price is lower than the open price.

Candlestick charts are popular among traders and analysts as they visually represent price patterns and trends, making it easier to analyze market sentiment and make trading decisions. By observing the various candlestick patterns and their formations, traders can gain insights into market dynamics and potential future price movements.

What is meant by a candlestick pattern?

A candlestick pattern is a specific configuration of candlesticks on a price chart that traders and analysts use to identify potential market reversals, trends, or continuation patterns. A combination of multiple candlesticks forms Candlestick patterns and provides insights into the psychology of market participants.

Candlestick patterns are categorized into two types: Single and multiple candlestick patterns.

Get Started With the Best forex Broker in India:

Single Candlestick Pattern:

Here are some of the single candlestick patterns,

Doji:

A Doji candlestick has a small body with an open and close that are very close to each other, forming a cross or plus sign shape. It represents indecision in the market, indicating a balance between buyers and sellers. Traders often see the Doji as a potential reversal signal, especially when it appears after a strong price move.

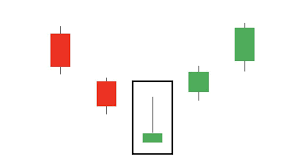

Hammer:

The Hammer candlestick has a small body at the top and a long lower shadow. It forms when the price significantly drops during the trading session but manages to recover and close near the opening price. The pattern suggests a potential bullish reversal, indicating buyers have entered the market and are pushing higher prices.

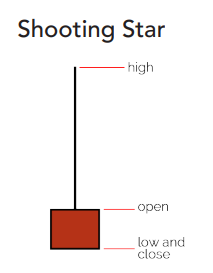

Shooting Star:

The shooting star candlestick has a small body at the bottom and a long upper shadow. It occurs when the price opens higher, rallies significantly during the session, but then reverses and closes near the opening price. The pattern suggests a potential bearish reversal, indicating that sellers have stepped in and are pushing the price lower.

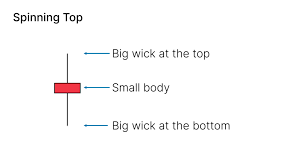

Spinning Top:

A spinning Top candlestick has a small body and long upper and lower shadow. It occurs when the price opens higher, rallies significantly during the session, but then reverses and closes near the opening price. The pattern suggests a potential bearish reversal, indicating that sellers have stepped in and are pushing the price lower.

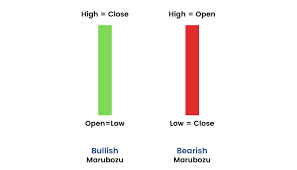

Marubozu:

A Marubozu candlestick has a long body with little to no shadows. There are two types: a bullish Marubozu, which has no upper shadow and indicates strong buying pressure throughout the session, and a bearish Marubozu, which has no lower shadow and suggests strong selling pressure. The pattern signifies a continuation of the existing trend.

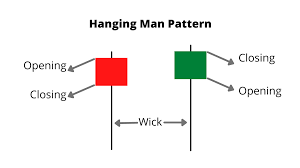

Hanging Man:

The Hanging Man candlestick has a small body at the top and a long lower shadow. It forms when the price opens higher, trades significantly lower during the session, but then manages to close near the opening price. The pattern suggests a potential bearish reversal, especially if it appears after an uptrend, indicating that the buying pressure is weakening.

Inverted Hammer:

The Inverted Hammer candlestick has a small body at the bottom and a long upper shadow. It occurs when the price significantly drops during the session but manages to recover and close near the opening price. The pattern suggests a potential bullish reversal, especially if it appears after a downtrend, indicating that the selling pressure is waning.

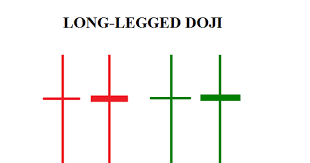

Long-legged Doji:

A Long-legged Doji has a small body with very long upper and lower shadows. It signifies strong indecision in the market and can suggest a potential reversal or trend continuation, depending on the context.

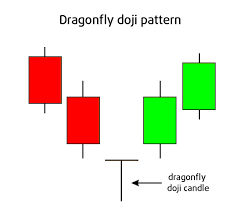

Dragonfly Doji:

A Dragonfly Doji has a small body at the top with a long lower shadow and no upper shadow. It typically indicates a potential bullish reversal when it forms at the bottom of a downtrend, suggesting that buyers have gained control.

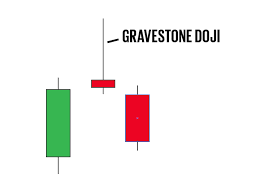

Gravestone Doji:

A Gravestone Doji has a small body at the bottom with a long upper shadow and no lower shadow. It often indicates a potential bearish reversal when it forms at the top of an uptrend, suggesting that sellers have gained control.

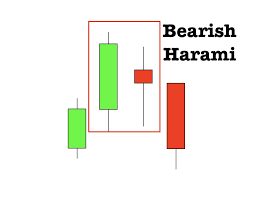

Bearish Harami:

The Bearish Harami pattern forms when a small bullish candlestick is followed by a larger bearish candlestick that is completely contained within the range of the previous candlestick. It suggests a potential bearish reversal.

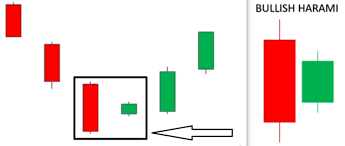

Bullish Harami:

The Bullish Harami pattern is the opposite of the Bearish Harami. It forms when a small bearish candlestick is followed by a larger bullish candlestick that is completely contained within the range of the previous candlestick. It suggests a potential bullish reversal.

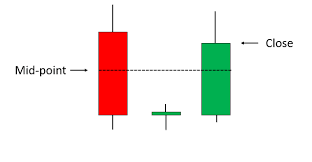

Morning Doji Star:

The Morning Doji Star is a three-candlestick pattern that begins with a bearish candlestick, followed by a Doji indicating indecision and ends with a bullish candlestick. It suggests a potential bullish reversal when it forms at the bottom of a downtrend.

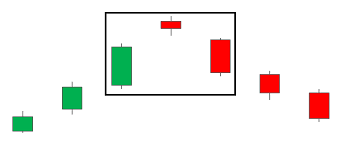

Evening Doji Star:

The Evening Doji Star is the opposite of the Morning Doji Star. It begins with a bullish candlestick, followed by a Doji, and ends with a bearish candlestick. It suggests a potential bearish reversal when it forms at the top of an uptrend.

These are just a few examples of single candlestick patterns. It’s important to note that single candlestick patterns should not be considered in isolation but rather in conjunction with other technical indicators and the overall market context for more reliable trading decisions. The Best Forex Broker In India provides a better platform to become a successful Trader by providing many Blogs to improve your skills.

Visit us at: www.milliva.com