Top 5 Forex Trading Books for Forex Traders

![]()

“A Good Book is Always The Best Companion”

Top 5 forex books every forex trader must read. Firstly, You cannot thrive in any industry without first learning the fundamentals as well as in forex trading. so, before you begin forex trading, you must have a fundamental understanding of how it is done and you must conduct research and study as much as possible.

Several excellent forex books created by fantastic writers that will assist you in trading and increasing your profits. Lets discuss about books every forex trader must read.

Top 5 Forex Books Every Forex Trader Must Read

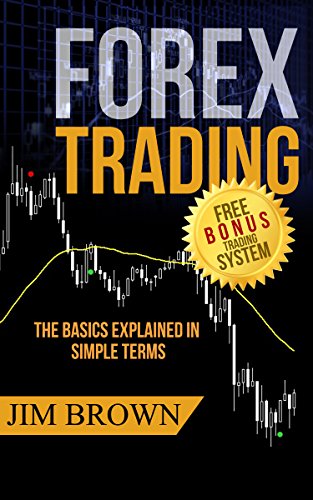

Forex Books 1 : Forex Trading: The Basics Explained in Simple Terms by Jim Brown

As the title suggests, this book geared toward teaching the fundamentals to amateurs. The author, also self-taught forex trader, sobecame interested in currency exchange and its earnings. Brown’s straightforward, succinct language jumps out in the book, which never assumes the reader’s understanding without being condescending. The following are some of the fundamentals:

1.The terms forex and forex markets defined in this article.

2.Entering and exiting strategies

3.The psychology of trading

4.The fundamentals of forex pairings

5.Locations where you may trade foreign currency

6.Advice on how to pick a broker

Forex Books 2: How to Start a Trading Business with $500 by Heiken Ashi Trader

Firstly most new traders who start their business have very little means of raising capital. Eventually its the best forex trading book. Which also focuses on a realistic approach to becoming a full-time trader with limited capital.

Including private traders. It also provides step-by-step guidance on how to approach the trading business with a capital of as low as $500. However, this foreign exchange trading book will not highlight how to rapidly expand the business to a large target, say $100,000. Some of the other important components of the book are:

1.How should one go about acquiring and implementing good trading habits?

2.What Does It Take to Be a Disciplined Trader?

3.Trading on the Social Web

4.Broker communication abilities

5.What does it take to become a Professional Trader?

6.Make the most of the $500 you have and make it feel like a lot more.

7.A Hedge Fund’s Trading Activities

Currency Trading For Dummies by Kathleen Brooks

This is a user-friendly explanation that explains how a FOREX market works and how one might profit from it. It provides an easy-to-understand introduction to the global FOREX market, outlining the market’s size, breadth, participants, and other important economic variables that impact currency prices, as well as how to analyze data and events properly.

To develop a concrete strategy and a game plan for execution, one will investigate numerous trading approaches. The following are the areas to concentrate on:

1.The convention on currency trading and its instrument

2.Giving you a behind-the-scenes look at what makes established and successful forex traders tricks.

3.Understanding the significance of planning and organization

4.Offering advice on how to avoid common trading traps and how to handle various types of risks.

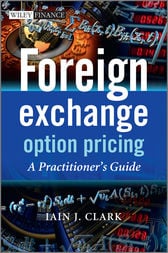

Foreign Exchange Option Pricing: A Practitioner’s Guide by Iain J. Clark

This book will cover all elements of FOREX options from the perspective of a finance practitioner, and also it will include all necessary knowledge for a trader or quantitative analyst working in a bank or hedge fund. It includes both the theoretical and practical aspects of mathematics, as well as implementation, pricing, and calibration.

Traders’ input and real-life examples used to create the curriculum. It will also offer the more typically requested products from FX options trading desks, as well as numerous methods for collecting risk characteristics that are necessary for appropriate product pricing.

Another topic discussed is the numerical methods necessary for model calibration, which is an important part of the practice but is often overlooked. The following characteristics are given special attention:

1.FX volatility management with precise market conventions

2.Settlement adjustments and options delivery delays

3.Under turbulent situations, Vanilla and Barrier option pricing contract.

4.Long-dated three-factor FX model

5.Techniques for numerical calibration for all models under consideration

6.Using partial differential equations or Monte Carlo simulation to develop variable techniques for extremely path-dependent alternatives.

Japanese Candlestick Charting Techniques by Steve Nison

Japanese Candlestick Charting Techniques by Steve Nison is credited with bringing this flexible technical analysis technique to the Western world, which is now frequently employed by forex traders. Candlestick charting, which is also utilized for futures, speculation, hedging, stocks, and anywhere else where technical analysis is done, is covered in depth in this book. Nison’s work is excellent for traders who want to improve their trading tactics. They might wish to examine one of Nison’s successors, The Candlestick Course, Beyond Candlesticks: New Japanese Charting Techniques Revealed, or Strategies for Profiting with Japanese Candlestick Charts, while they’re at it.

Key Takeaways

1.Do some study before you start.

2.Choose a book that will assist you at the moment.

3.It is critical to not only learn but also practice.

4.Take your time; it’s time well spent when it’s for a good cause.

Visit us : www.milliva.com