What is Social Trading In Forex

![]()

As it allows traders to mimic other people’s positions. And communicate with their peers, social trading is a well-liked method of gaining access to the financial markets. Learn about the dangers associated with it and how it functions.

What is Social Trading?

Social trading is a type of trading. That allows investors and traders to imitate and put into practice the techniques of their peers or more seasoned traders. Despite the fact that the majority of traders conduct their own fundamental and technical analysis. There is a subset of traders that prefer to watch and mimic the analysis of others.

Because it allows traders to communicate with one another. Observe one another’s deals, and gain insight into how others make decisions. It is frequently view as a form of social network.

How It Works Out?

Quick access to financial markets is how it works. Allowing both new and seasoned traders to discuss techniques and imitate each other’s moves. In truth, it is now simpler than ever to become a social trader thanks to modern technologies and sophisticated platforms. You can either adopt the entire technique or certain components by using a full social trading platform.

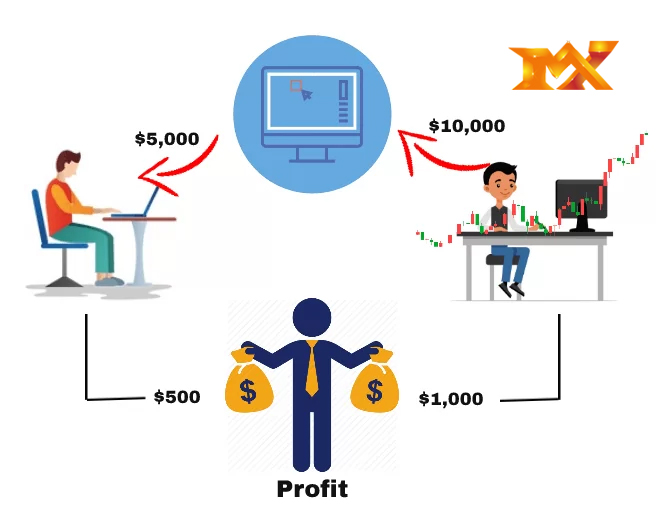

Some traders might prefer to use a it platform that is completely integrate and allows for complete strategy sharing via a “copy trading” or “mirror trading” function. A social trader may decide to “subscribe” to another trader’s channel, whose positions would be publish on a live feed with the opportunity to imitate their trades, much like on a social networking site. As a result, if trader A conducts a trade, trader B will do the same thing immediately.

Because social trading networks typically contain a leader board base on popularity and success rate, experienced traders have an incentive to share their trading tactics because they are frequently reward with both money and status.

As an alternative, traders could use the social trading tenets while still maintaining command over their transactions by employing a variety of signals and indicators. It can serve as confirmation for other types of analysis by observing market sentiment and other traders‘ activities.

Social Trading has Several Benefits

As you may anticipate, incorporating copy trading and social trading into your entire approach may be advantageous. You can quickly and easily register to “copy trade” when you locate a trader who interests you. In addition to other advantages, this exposes you to different markets where you might be interest.

Social Trading Advantages

Money for the Novice: It almost seems customary for new traders to lose a significant amount of money when they first enter the market. This allows even novice traders to make money by following more experienced traders.

Additionally, traders have the option to follow the indications of experienced traders and copy their trades automatically or manually. How automatically? We’ll discuss that afterwards.

Learn and Grow (Your Money): In this, traders have the chance to examine the tactics used by eminent experts with years of experience. Their trading game becomes stronger as a result, and the likelihood of suffering losses is also decrease.

Trader autonomy: When using automated trading, traders are constrain by predetermine rules and programs for entering and quitting deals. However, with it, the trader has more control over the choices made in relation to each trade. Thus, many of the dangers associate with automatic trading remove.

Trade on Social Networking Sites

Since many novice, experience, and professional traders participate in this networks, there are numerous viewpoints on a given investment or on techniques that evaluated as a whole.

Transparency: Many (so-called) pro-investors have established Telegram channels where they share their opinions. These “so-called pro investors” don’t back up their claims with deeds. This platforms have regulations governing this so they can track the precise amount an investor has invested.

Risks

Let’s examine the potential drawbacks of social trading now:

Time Consuming: Social trading may take a lot of time because there are many stocks to study and expert portfolios to research.

Missed Opportunities: Since trades are performed manually in social trading rather than automatically, there is a very high likelihood that you will pass up certain opportunities if you are even somewhat careless.

Impulsive Trading: Social trading takes place in groups, and groups have a propensity to exaggerate news or market sentiments. This results in an inaccurate market indication.

Visit us : www.milliva.com